Soybean oil spread with great profit potential

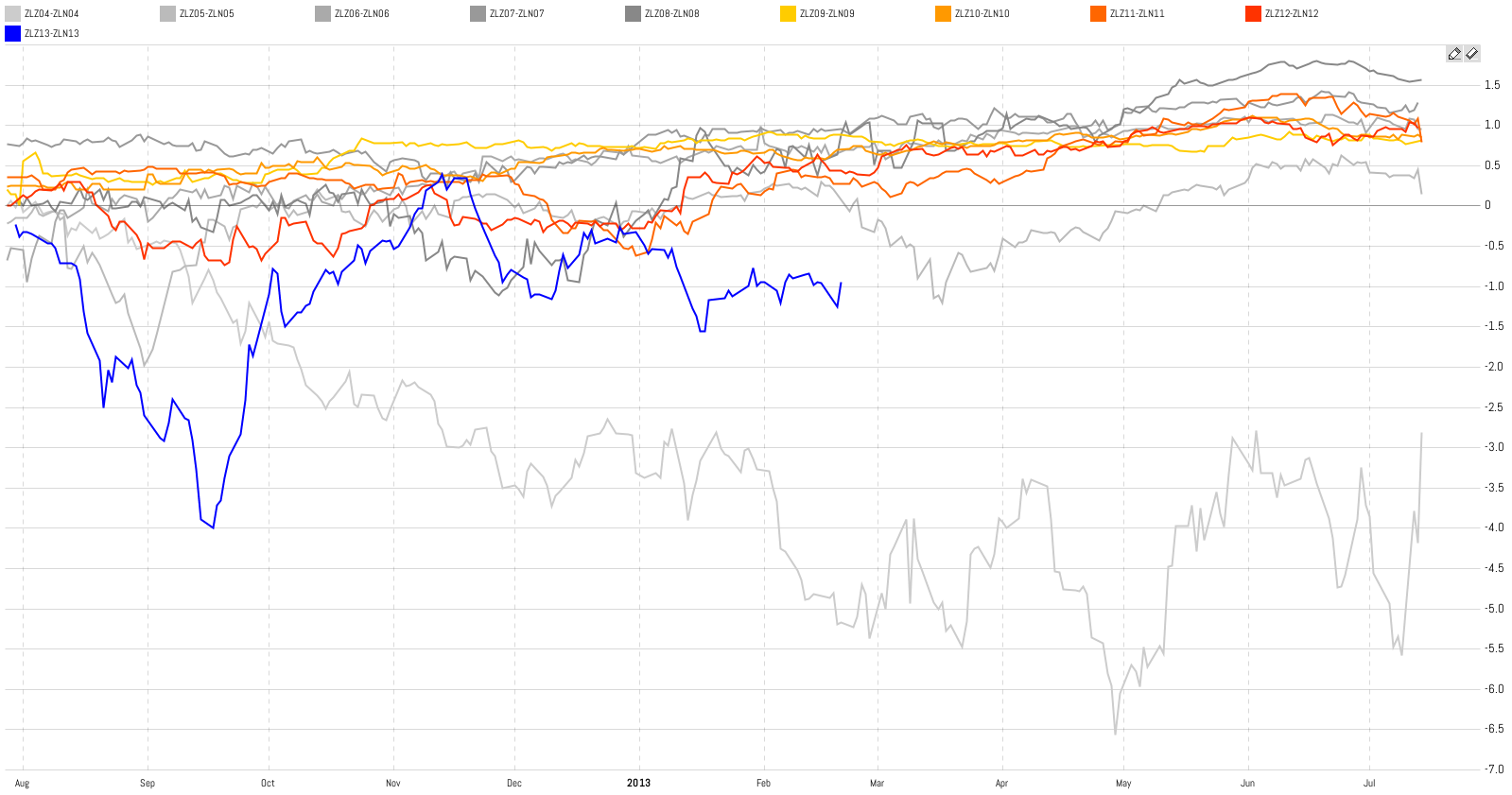

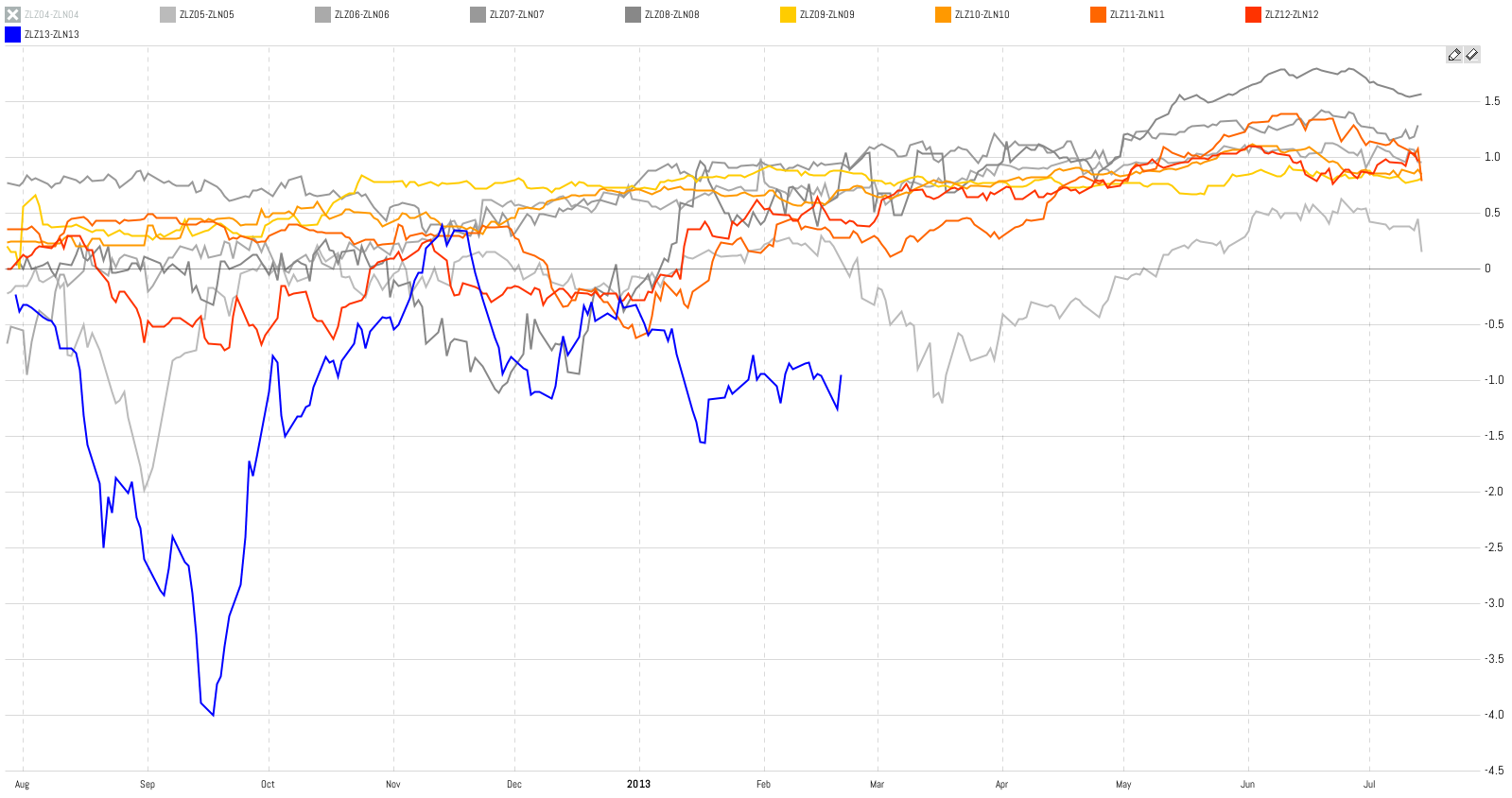

Today I have one more volatile (and therefore risky) spread. But despite volatility, this trade still has a very good RRR (risk reward ratio). The trade I’m talking about is the soybean oil interdelivery spread ZLZ13-ZLN13:

Based on the picture above the technical setup is not great but still favorable. Price seems to have found a base between -1.5 and -1.0. More important here is the seasonal setup as you can see in this study on app.spreadcharts.com:

ZLZ04-ZLN04 is an abnormal year. Take it as a warning that nothing is sure even in spread trading. But for our cause, it’s better to hide this year by clicking on it in the legend. We get this picture:

I think the seasonal trend is clearly visible now. The spread usually expires near 1.0. Given the current price, it gives us a nice profit potential of $1200 per contract. Which is nice.

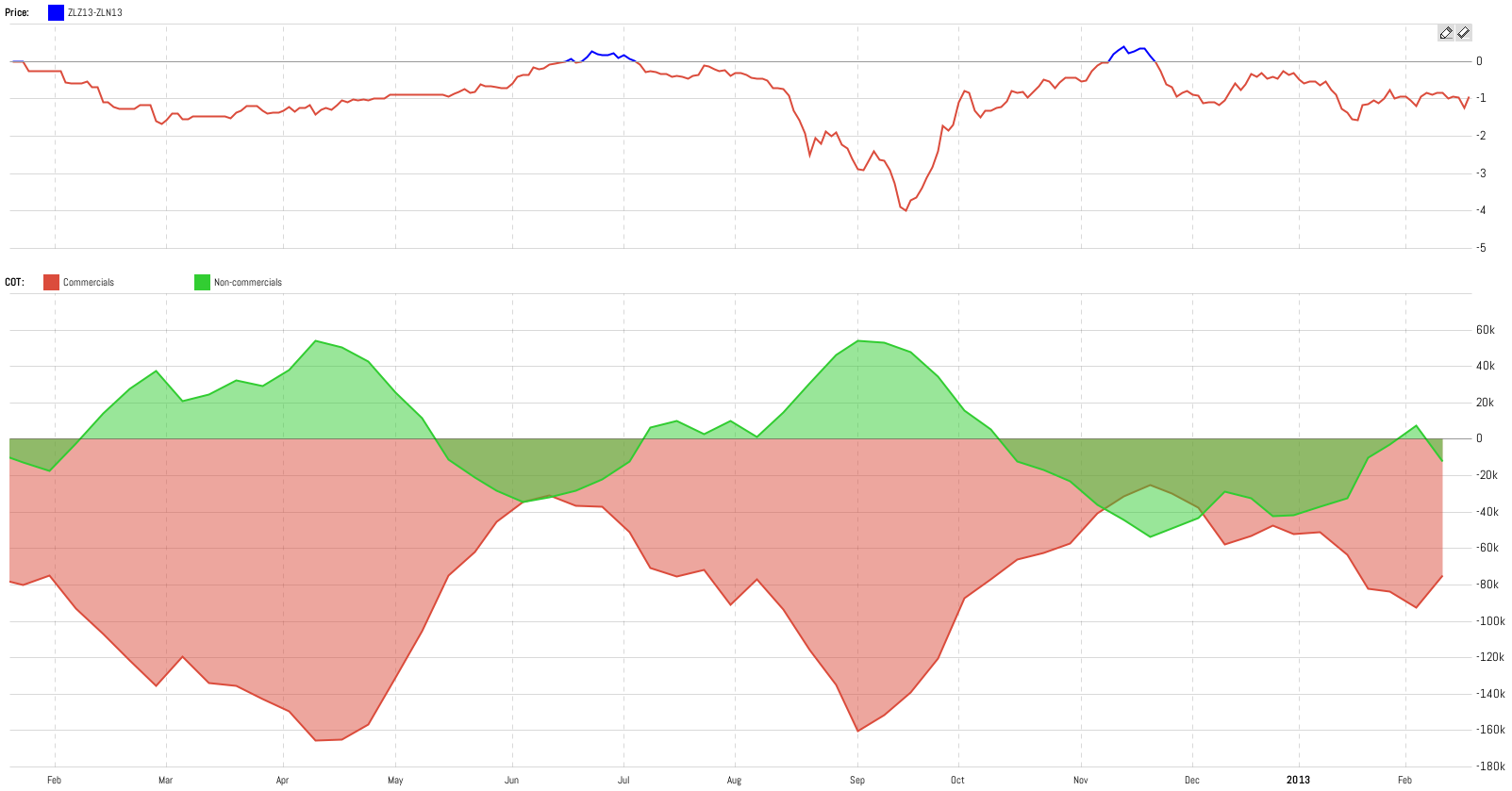

Maybe I haven’t mentioned it in this blog yet but the Commitments of Traders is a great tool in commodity futures and spread trading. Especially interdelivery spreads are great for deploying this tool. Our app has a comprehensive Commitments of Traders analytics tool. So let’s take a look:

This is not a time to write about COT (I will do it later) but even if you don’t know what the COT is you should clearly notice the correlation between the price and corresponding Commercial and Non-commercial position curves. Simply said the current COT position distribution is not as good as it was in September of last year but still quite favorable for this trade.

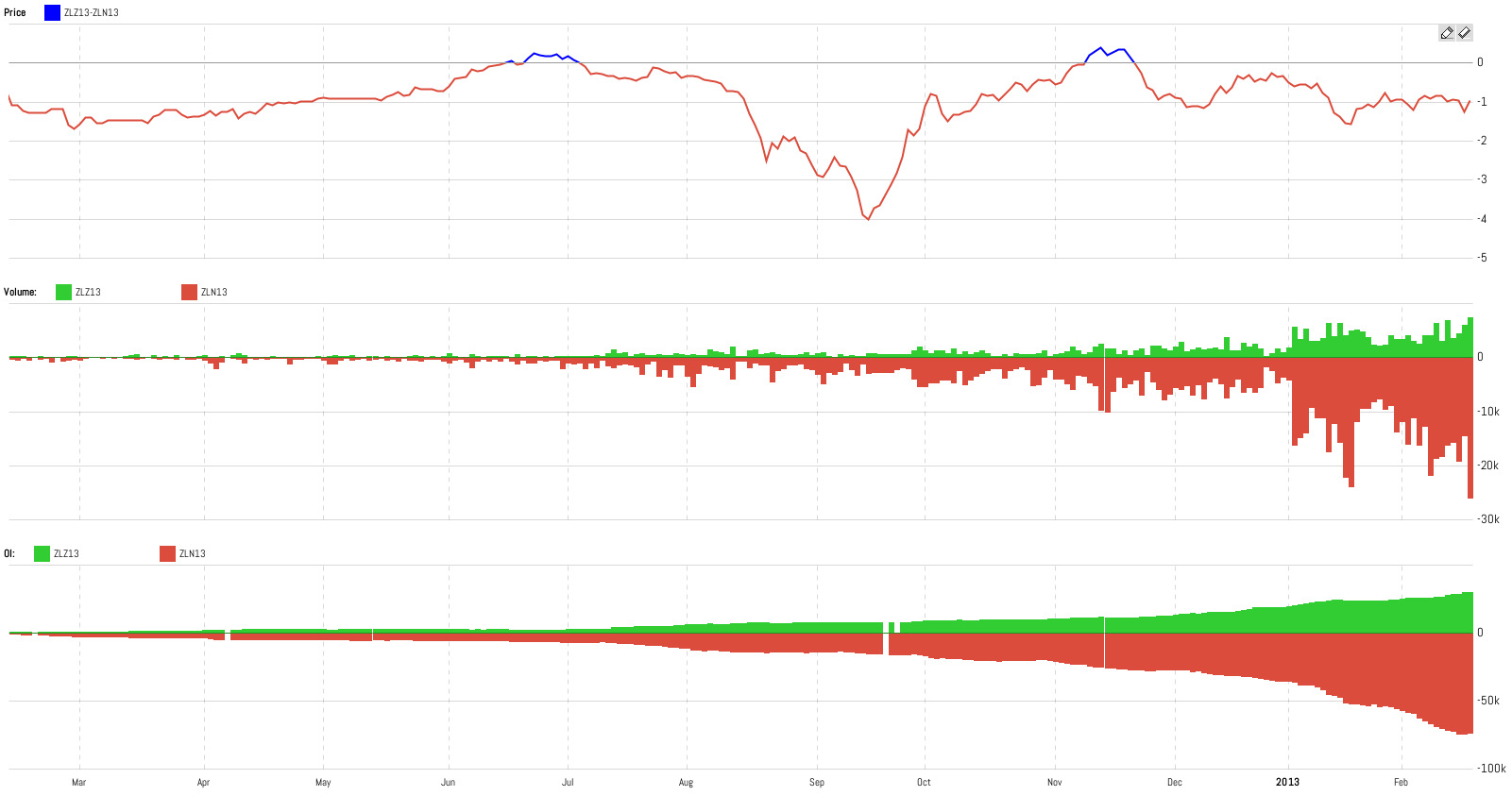

The last thing is liquidity which is great for both legs of the spread:

Check out also these great articles

Why trade SGX Rubber?

Last time, we introduced the SGX data in the SpreadCharts app and briefly described the...

Read moreIntroducing commodities in Singapore

We are thrilled to announce that we have obtained a license to distribute market data...

Read moreA bunch of new data

A bunch of new data has been added to the SpreadCharts app! This includes data...

Read moreLaunching an improved model for signals

I personally consider the signals generated by our AI model to be the cornerstone of...

Read more