Understanding commodity ETF decay

In the previous article, I explained the compounding effect and the reason why leveraged ETFs lose value over time. Today, we’ll take a look at commodity ETFs. These funds can decay very fast, even if they are non-leveraged. That’s because the mechanism of decay is of a different nature than that of leveraged ETFs holding stocks.

Most commodities can’t be held directly because of complicated and costly storage. Most of the ETFs, therefore, realize the long position in a commodity by buying corresponding futures. Once the futures contracts are approaching expiration, the fund sells them and buys futures with a further out expiration. It is, in fact, a perpetual rolling in time. This rolling is, however, taking a toll on the fund’s net asset value (NAV). That’s because most commodities are in contango most of the time. Contango is a normal situation where further out contracts are more expensive than the nearby contracts. By rolling the positions, the fund is repeatedly selling cheaper nearby contracts and buying more expensive further out contracts. Buying expensive and selling cheap translates into a loss for the fund.

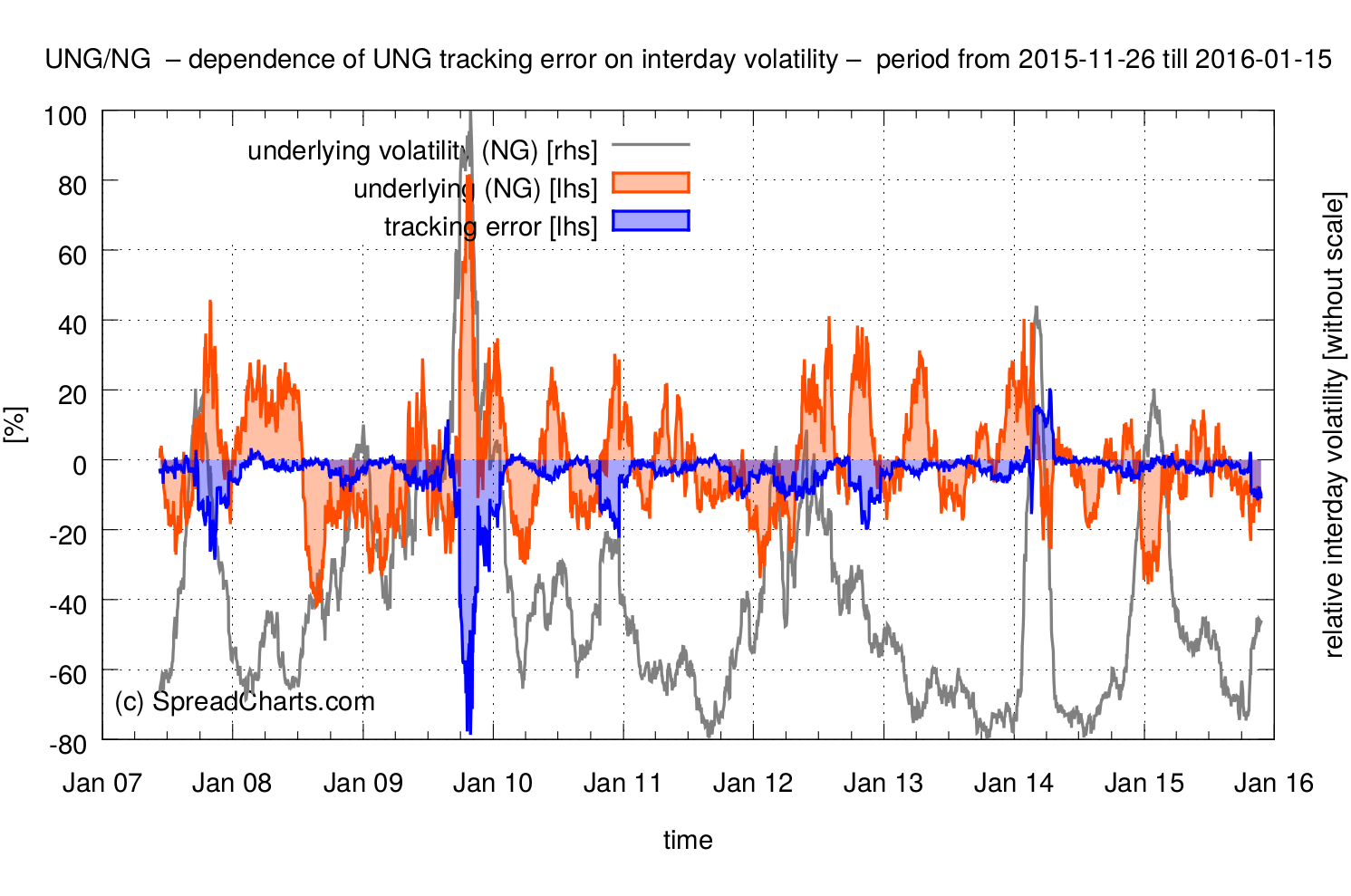

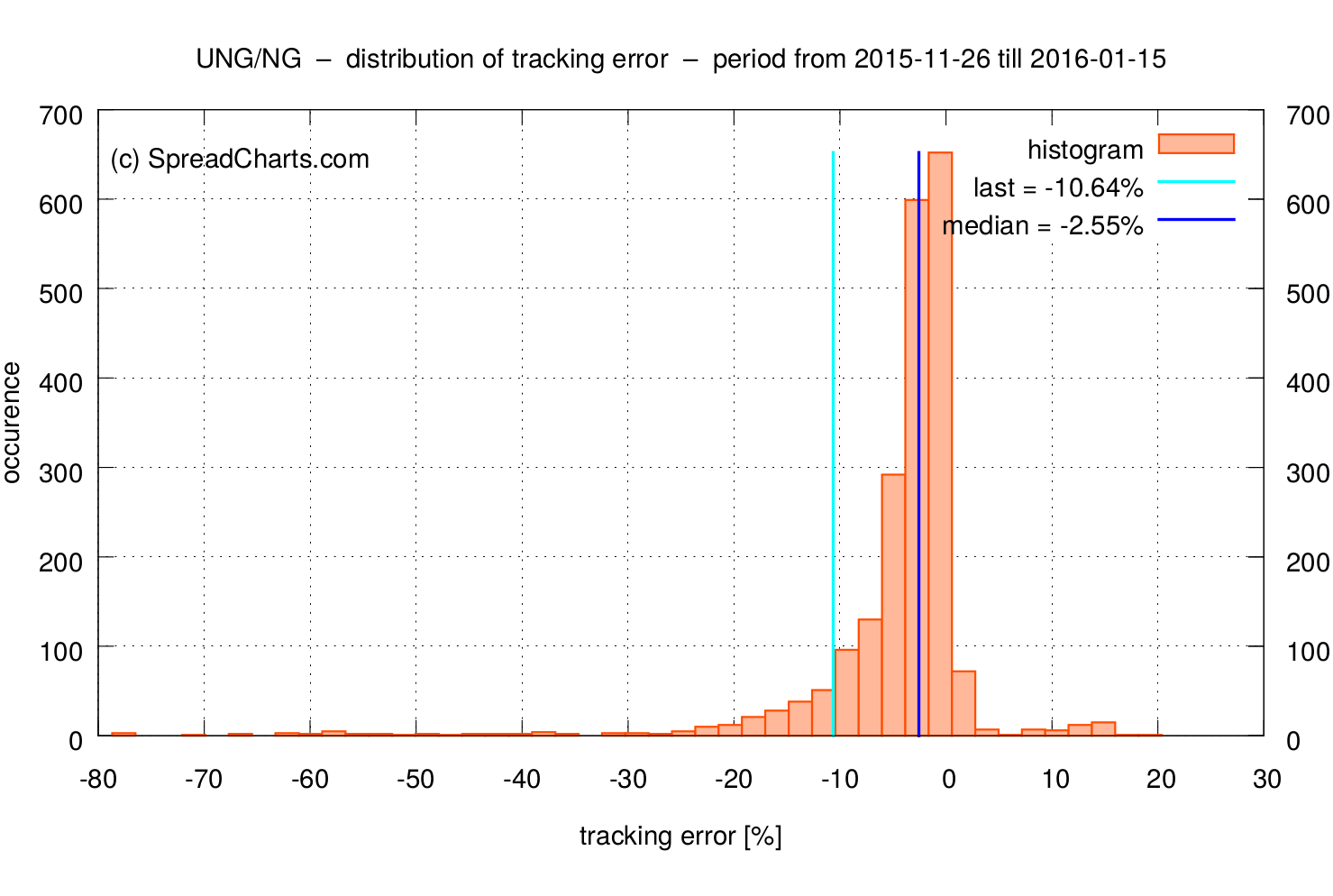

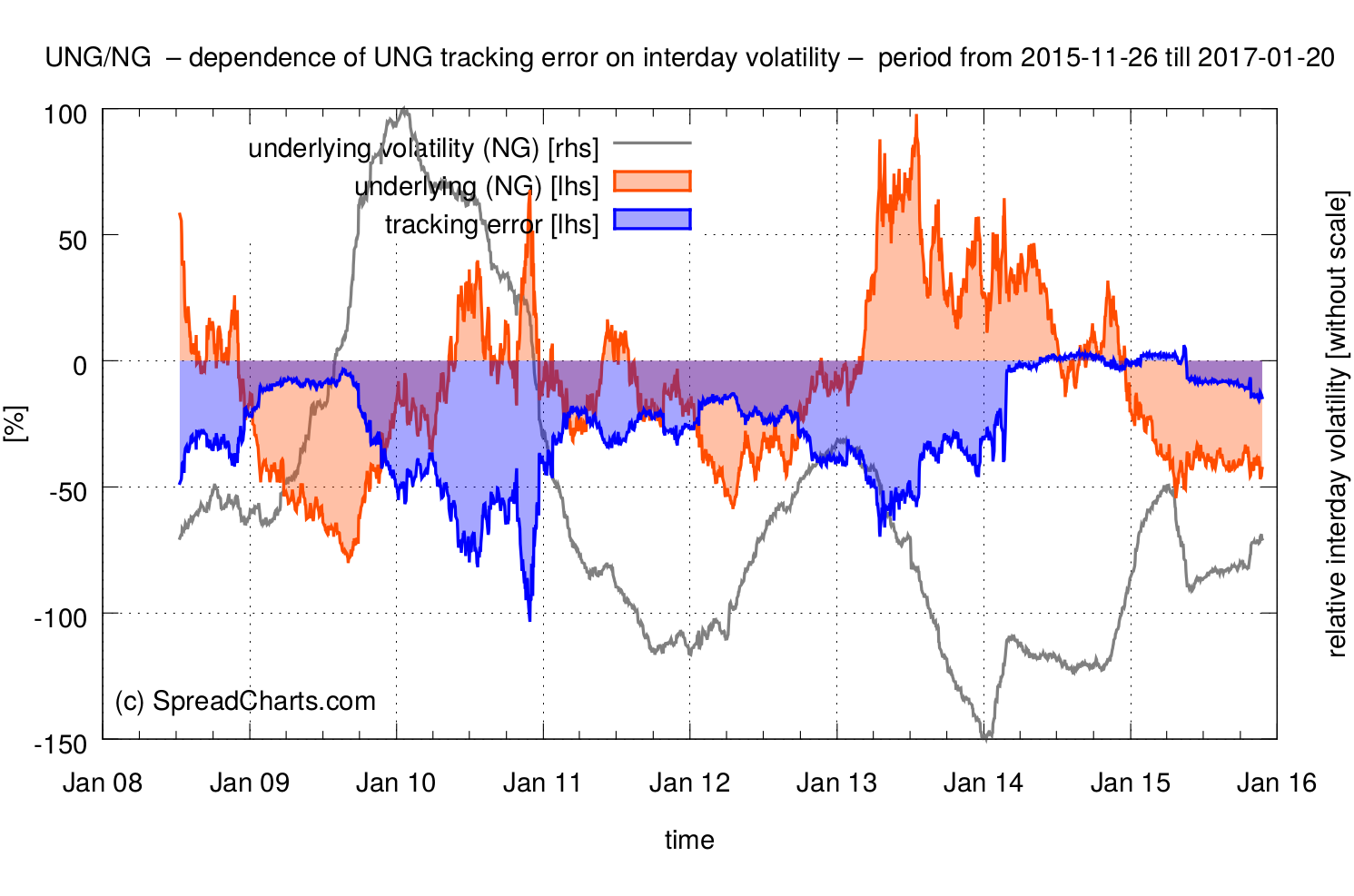

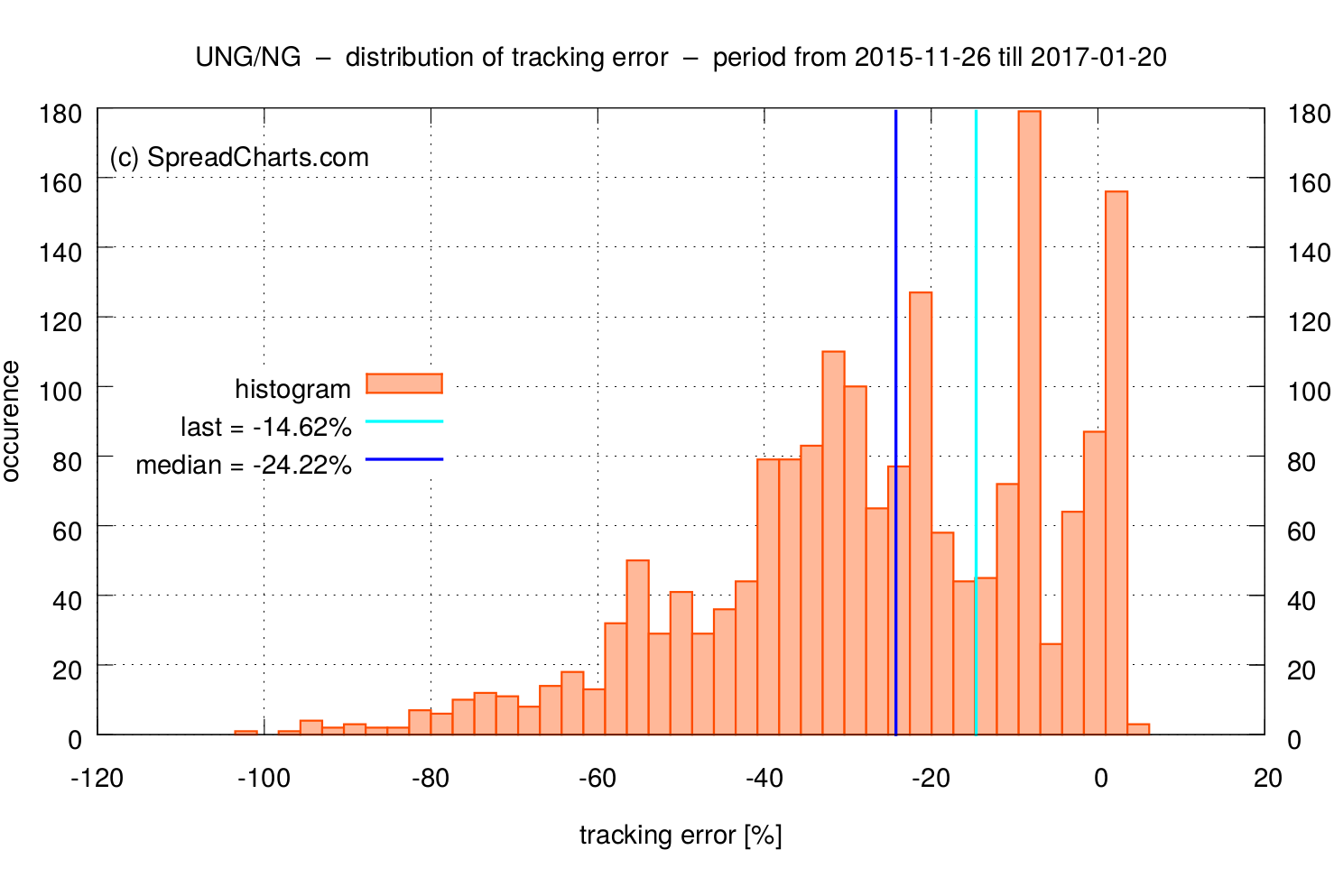

The following charts are showing decay (tracking error) for UNG, the ETF on Henry Hub natural gas. I picked the same expiration dates as last time. However, the charts were generated two weeks later, so the period to expiration is shorter. Despite this, the expected tracking error for UNG is much higher than it was for TNA. For example, it’s 25% for January 2017 expiration, which is very significant.

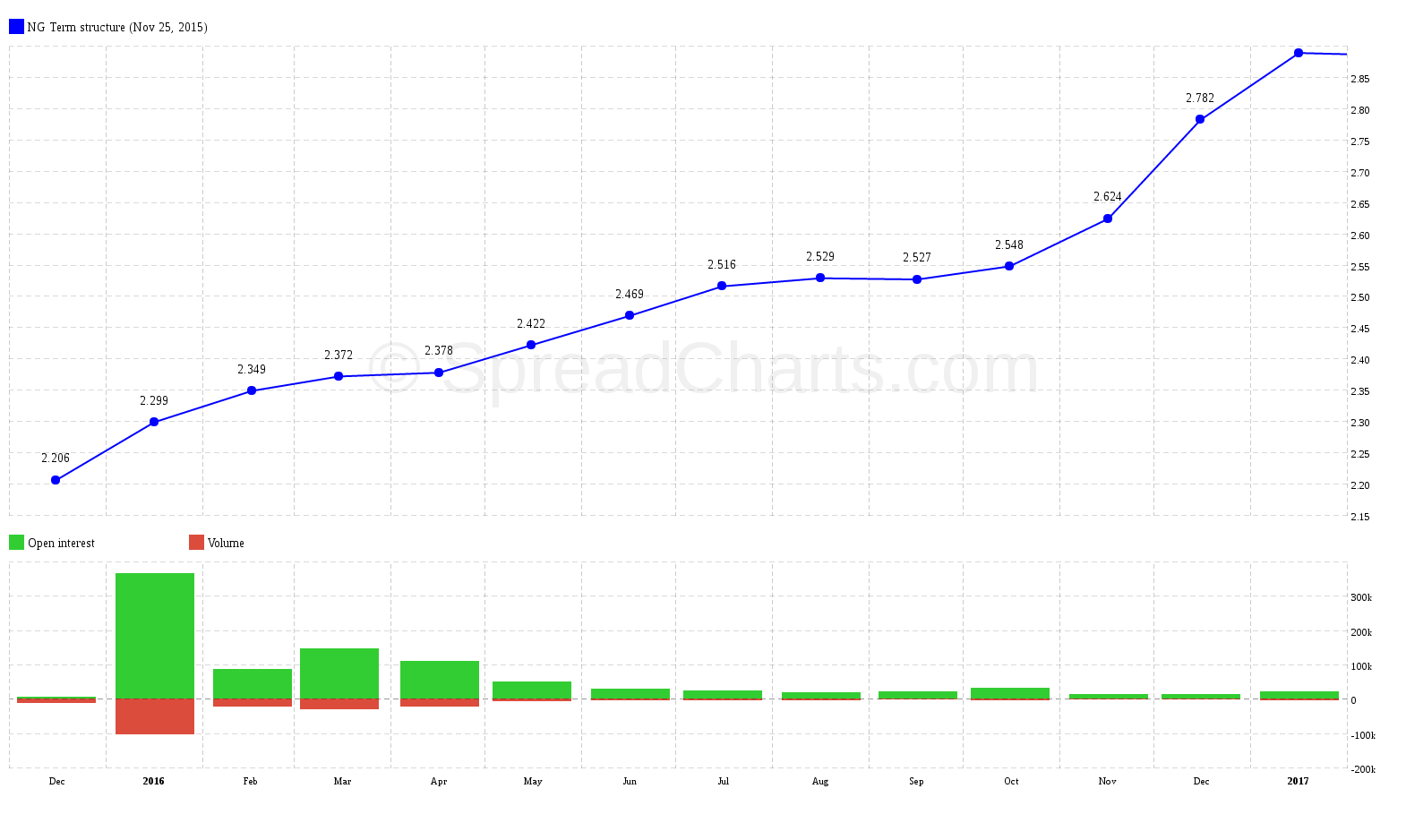

The reason for such a high rate of decay is shown in the next chart. It’s the term structure for the underlying futures (natural gas). Basically nothing more than closing prices on Nov 25th, 2015 for futures contracts expiring in about a year. As you can see, the contracts that are closer are much cheaper than those farther away.

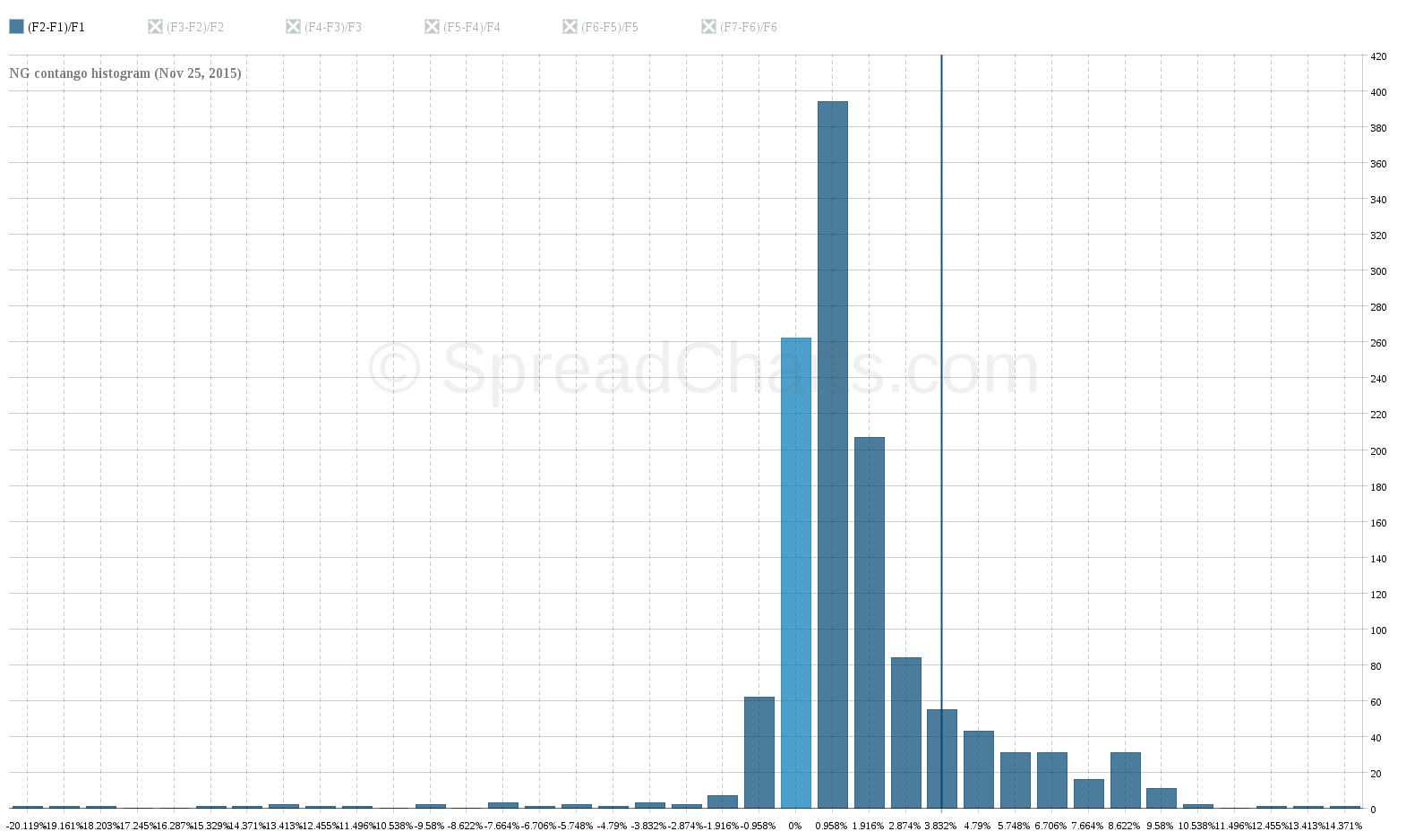

And this state is not exceptional. On the contrary, contango in natural gas is positive most of the time, as you can see in the contango histogram between the two nearest contracts (which UNG actually holds) for past 5 years.

Overall, UNG is not suitable for holding over longer periods of time as it suffers from decay a lot. However, what’s a disadvantage for someone, can be an opportunity for someone else…

Check out also these great articles

Why trade SGX Rubber?

Last time, we introduced the SGX data in the SpreadCharts app and briefly described the...

Read moreIntroducing commodities in Singapore

We are thrilled to announce that we have obtained a license to distribute market data...

Read moreA bunch of new data

A bunch of new data has been added to the SpreadCharts app! This includes data...

Read moreLaunching an improved model for signals

I personally consider the signals generated by our AI model to be the cornerstone of...

Read more