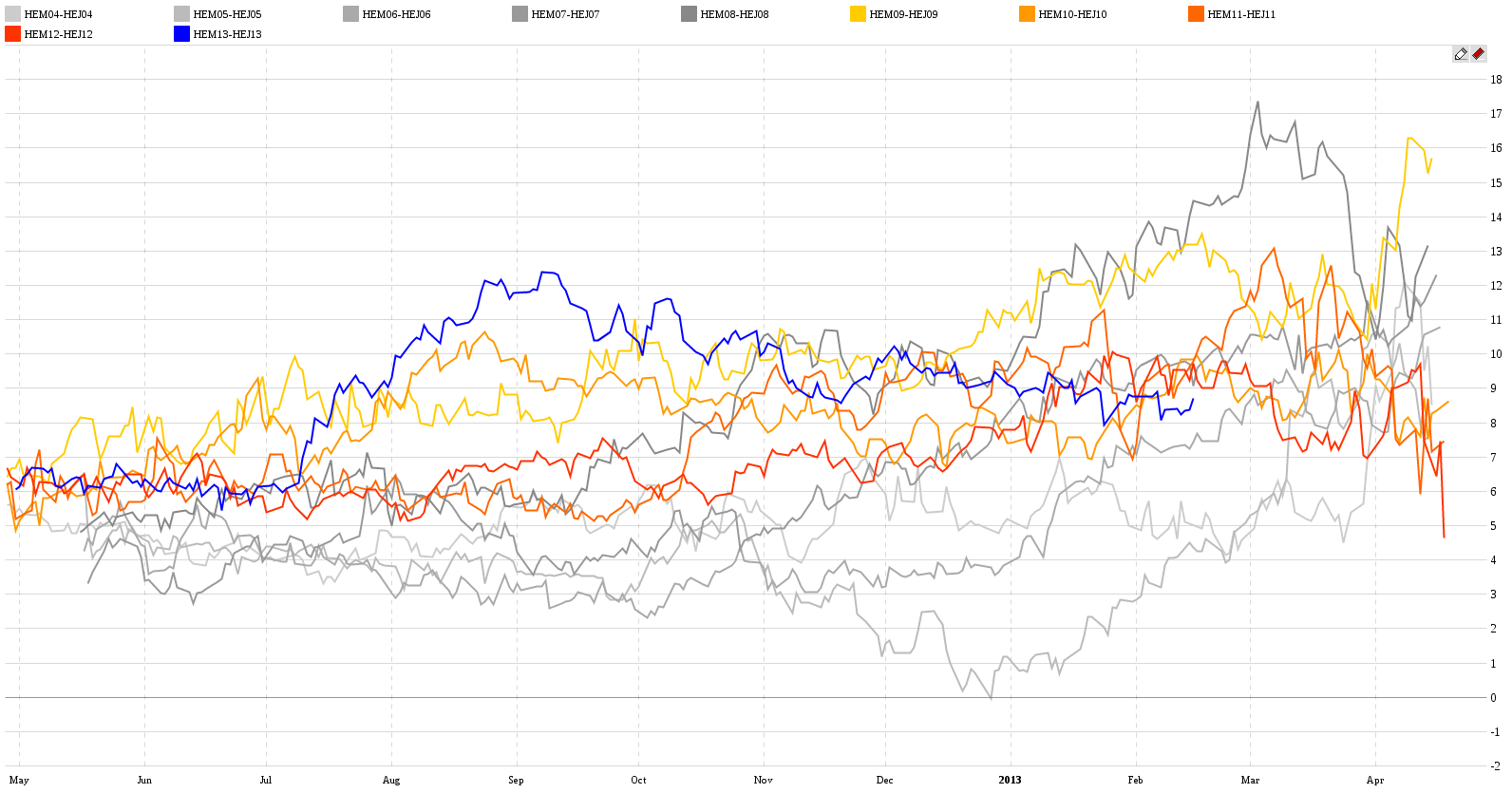

Crowded hogs spread

Lean hogs are good for spread trading. So good that many people are watching it. I’ve seen recommendations to enter this trade during past weeks in many newsletters and from people on Twitter. The spread I’m talking about is HEM13-HEJ13. So, as I’ve said, most people who wished to enter this spread are probably already in. But the price itself hasn’t moved much. I traded this spread few times and it was always a successful trade for me. This year I passed on it because the spread had risen unexpectedly in July last year and has been trading above average since then. So I don’t think it’s a great trade right now but the spread is very slow moving, the risk is small and therefore RRR is good…so why not to try?

As you can see in the app technical study above, the price seems to be breaking up. Keep in mind it can be a false signal but as I’ve said, the risk is small. I would set a stop-loss slightly below 8.0. Seasonality is still strong and can easily push the spread above 11 or maybe even 12.

If that happens I would take my profit and leave the trade. Remember this trade is quite crowded so staying too long in it isn’t a good idea. Although the price is moving slowly right now, it can get volatile near the expiration when everybody is getting out. If you decide to try this trade then don’t forget to keep a tight stop-loss.

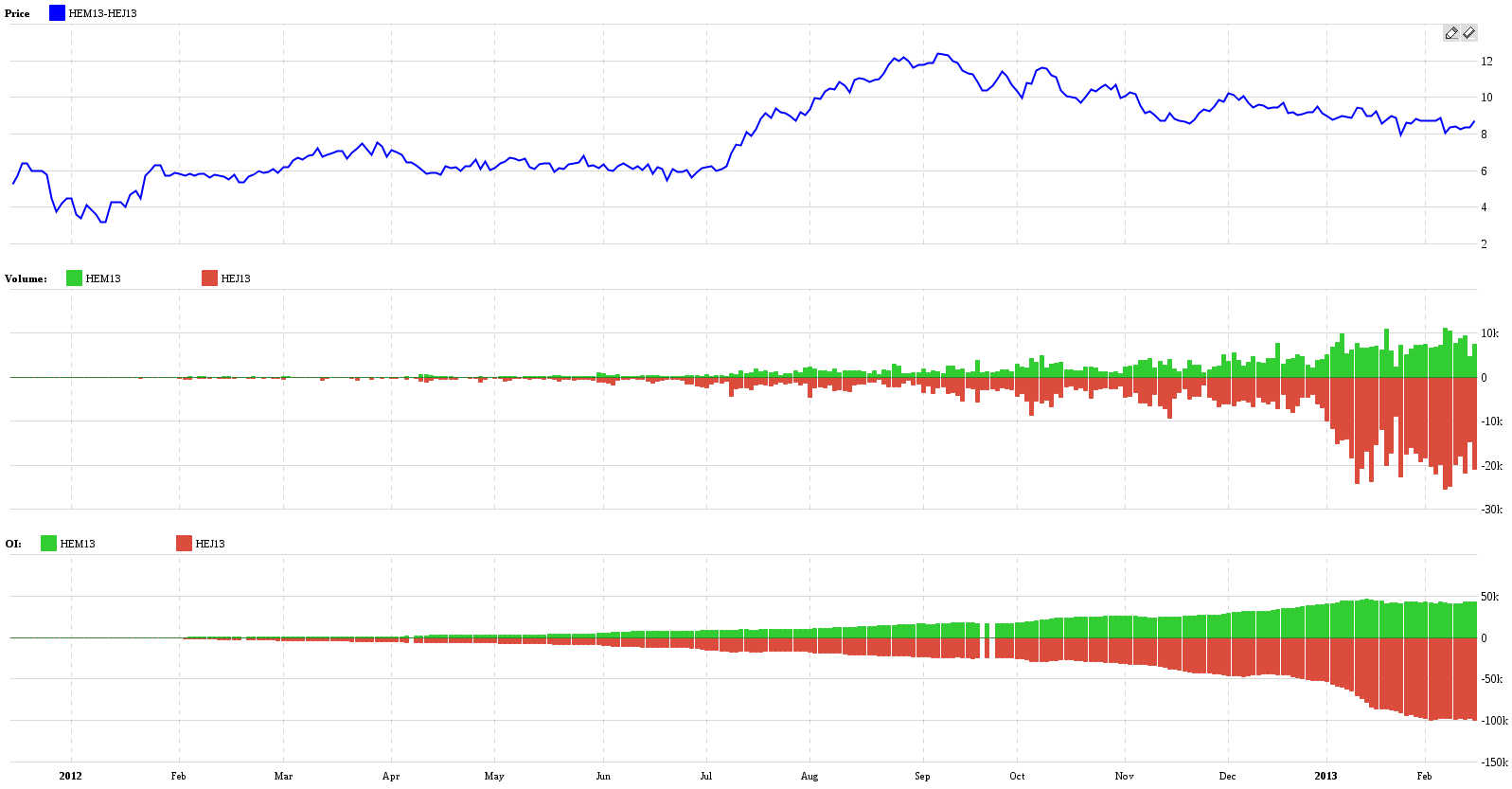

Liquidity is good:

Check out these great articles as well

New data: Sector indices

Our software is already established well beyond commodity market analysis. Stock indices, currencies, and even...

Read moreWhat’s new in the SpreadCharts app?

It’s been a few months since we launched the new version of the SpreadCharts app....

Read moreA major new version of the app is here

Today, we’re excited to show you the major new version of the SpreadCharts app that’s...

Read moreLiberation Day!

Tariffs are arguably the dumbest part of Trump’s agenda. Yes, the goal makes perfect sense,...

Read more