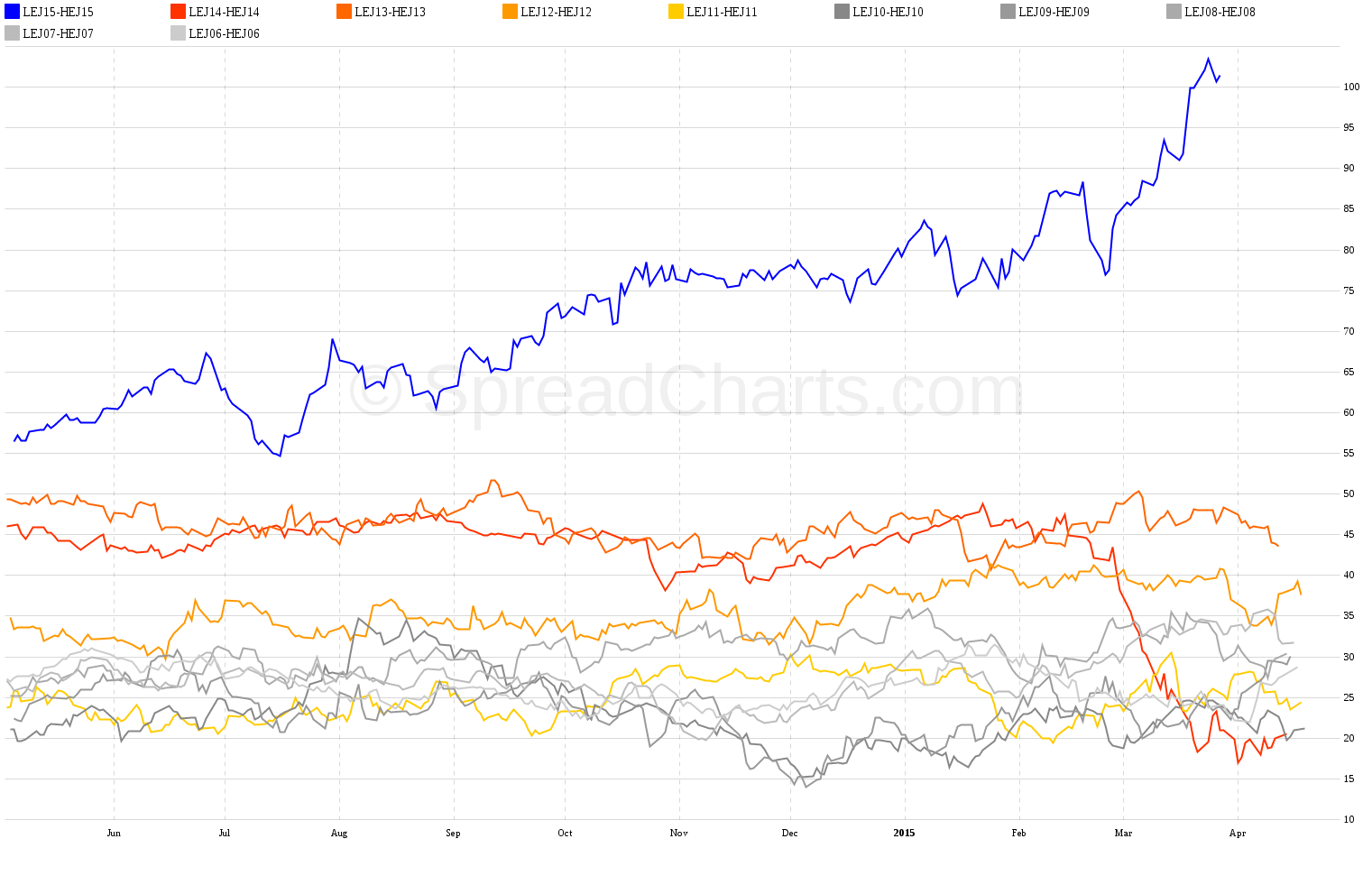

Cattle-hog spreads at unsustainable levels

The nearest spread between live cattle and lean hogs (LEJ15-HEJ15) was formerly considered wide at levels above 30c. It’s trading above 100c right now and still rising. This situation is unsustainable from the long term perspective. It’s only a matter of time before these markets at least partially converge. The profit potential is great, but timing the entry is like catching a falling knife.

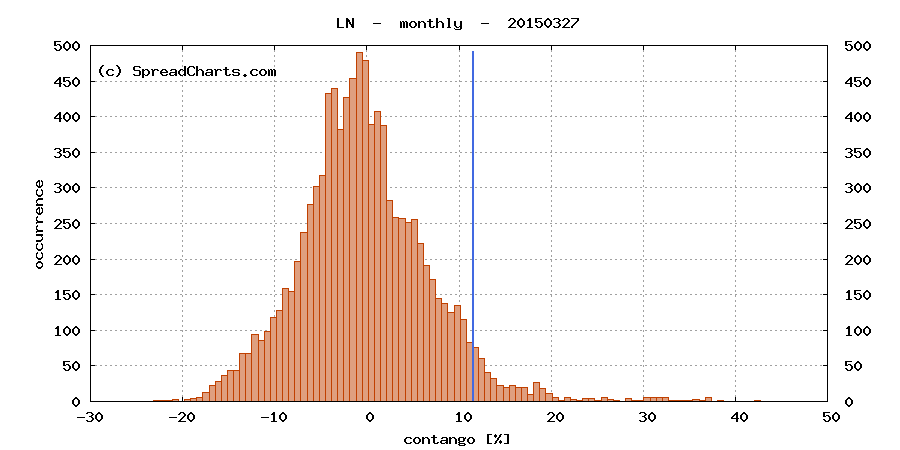

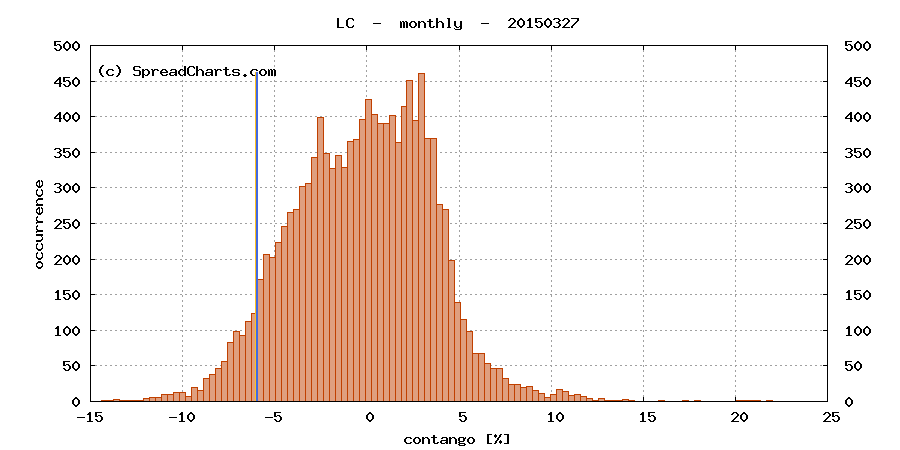

Rolling the trade into a more distant expiration is complicated by extreme contango in hogs (blue vertical line in the LN histogram) and strong backwardation in cattle (blue vertical line in LC histogram) – both effectively act against any short cattle & long hogs trade.

Given the high risk, I would personally consider using options on futures to trade this idea. I would choose the August expiration and create two vertical spreads. One using call options on cattle and the other using put options on hogs. That would mitigate my risk while allowing me to exploit this unique market divergence.

Check out these great articles as well

New data: Sector indices

Our software is already established well beyond commodity market analysis. Stock indices, currencies, and even...

Read moreWhat’s new in the SpreadCharts app?

It’s been a few months since we launched the new version of the SpreadCharts app....

Read moreA major new version of the app is here

Today, we’re excited to show you the major new version of the SpreadCharts app that’s...

Read moreLiberation Day!

Tariffs are arguably the dumbest part of Trump’s agenda. Yes, the goal makes perfect sense,...

Read more