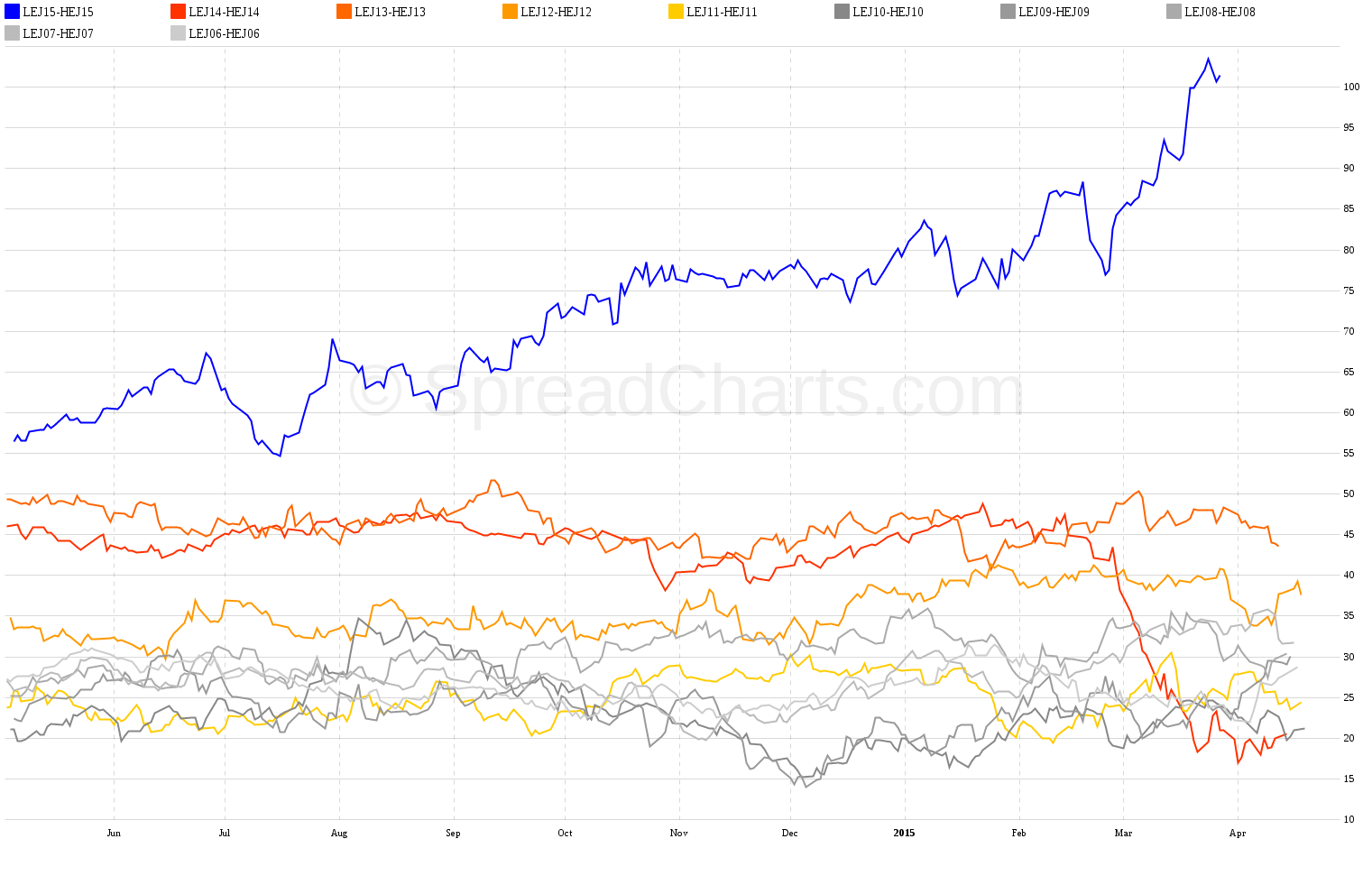

Cattle-hog spreads at unsustainable levels

The nearest spread between live cattle and lean hogs (LEJ15-HEJ15) was formerly considered wide at levels above 30c. It’s trading above 100c right now and still rising. This situation is unsustainable from the long term perspective. It’s only a matter of time before these markets at least partially converge. The profit potential is great, but timing the entry is like catching a falling knife.

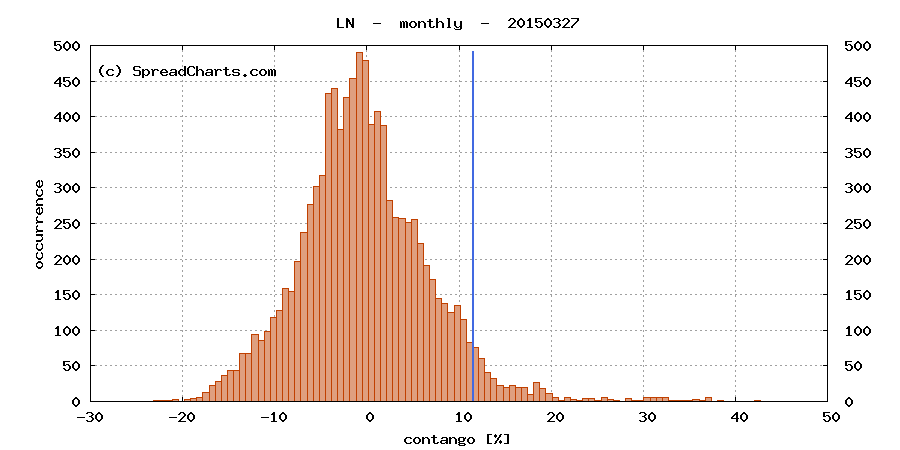

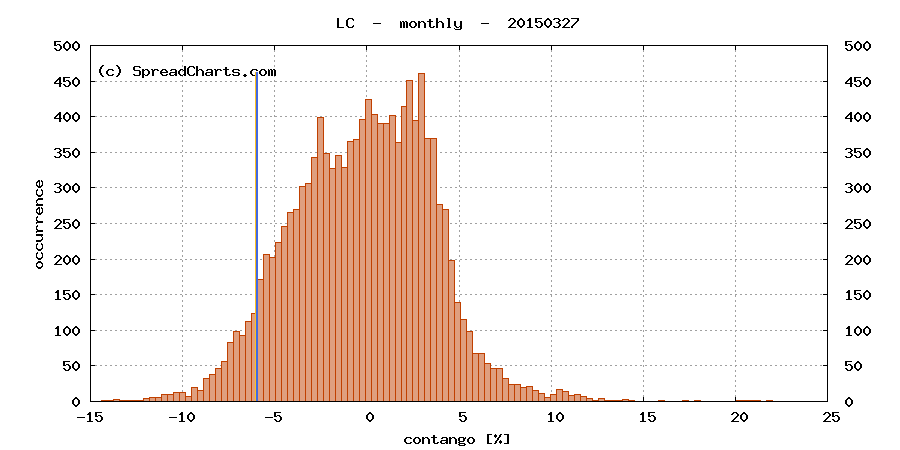

Rolling the trade into a more distant expiration is complicated by extreme contango in hogs (blue vertical line in the LN histogram) and strong backwardation in cattle (blue vertical line in LC histogram) – both effectively act against any short cattle & long hogs trade.

Given the high risk, I would personally consider using options on futures to trade this idea. I would choose the August expiration and create two vertical spreads. One using call options on cattle and the other using put options on hogs. That would mitigate my risk while allowing me to exploit this unique market divergence.

Check out also these great articles

Did you catch the move in Bitcoin?

Have you made money on this incredible move in Bitcoin? Well, you should have. On...

Read moreInsights from the iron ore market

After explaining why Rubber futures can be a great market for traders, we will focus...

Read moreWhy trade SGX Rubber?

Last time, we introduced the SGX data in the SpreadCharts app and briefly described the...

Read moreIntroducing commodities in Singapore

We are thrilled to announce that we have obtained a license to distribute market data...

Read more