Why trade SGX Rubber?

Last time, we introduced the SGX data in the SpreadCharts app and briefly described the history of commodity trading in Singapore. Today, we will take a closer look at the most interesting futures contract from trader’s perspective – the Rubber futures.

Before moving on, I must clarify that there are actually two rubber futures contracts traded on the SGX – the TSR20 and RSS3. Both are made from natural latex harvested from rubber trees. Technically Specified Rubber (TSR) is liquid latex which has been allowed to congeal naturally and reformed into blocks that can be used in tyre manufacturing. Ribbed Smoked Sheet (RSS) is liquid latex rolled into sheets and put through a smoking process.

What will be important for us is that TSR20 is much more liquid contract than RSS3, so I’ll focus exclusively on the TSR20 contract from now on. Detailed specifications for both contracts are listed at the end of this article.

Why you should be interested in SGX Rubber:

- Physical settlement

- Seasonal behavior

- Small contract size

- USD denominated

Physical settlement

Futures contracts can be settled either financially or physically. Physical means that the contract must be settled by the actual commodity upon its expiration, not merely with cash. Why you should care about this, if you’re just a trader? Well, physical settlement ensures that the contract closely tracks the price of the underlying commodity. It leads to fewer failures in futures convergence to spot prices at expiration, and the contract is more popular among hedgers. The reason you should care is that as a speculator, you want the futures’ price to accurately reflect the true conditions in the physical market. Imagine entering a trade and failing to profit from it, even if the market evolves as you expected.

However, this can be a double edged sword sometimes. Remember the negative crude oil prices in spring 2020? Well, it happened just on the WTI contract, primarily due to its physical settlement. By contrast, Brent futures, which are financially settled, did not experience negative prices during the same period.

When you trade a physically settled contract, you trade an actual commodity. Such contracts are rare in Southeast Asia, as physical delivery requires extensive storage and loading facilities. That’s why most contracts are cash-settled.

Seasonal behavior

Rubber exhibits notable seasonal trends. If you follow us for some time, you know that we do not consider seasonality as something reliable. It does fail terribly form time to time. Nevertheless, it can serve as an important tailwind for your trades if other data is aligned with it. And rubber shows strong seasonal patterns.

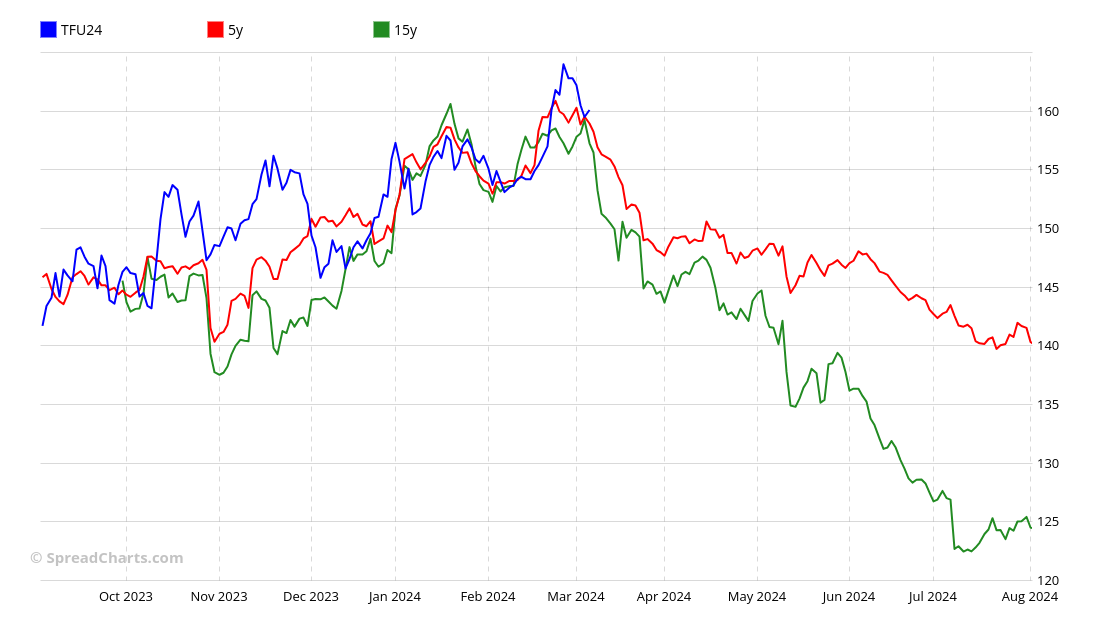

For instance, a nice seasonal uptrend has just concluded, which the price followed rather well this year. And now, a strong seasonal downtrend is beginning.

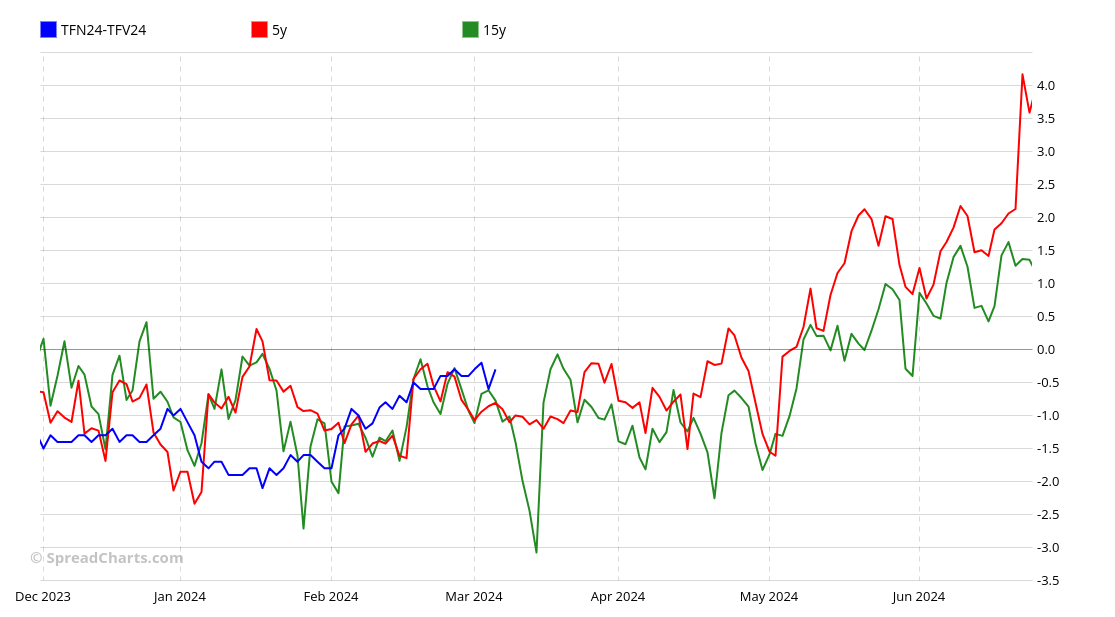

This seasonal behavior is evident not only in outright futures but also in interdelivery spreads.

Small contract size

This is a huge advantage for retail traders. Futures contracts tend to be large for historical reasons. First of all, only professional traders and hedgers traded them in the 20th century. These were usually large firms and the contract size was tailored for them. Moreover, trading commissions were much higher before the advent of electronic trading and purchasing one big contract was more cost effective than buying a couple of smaller ones.

This is no longer the case. Now, smaller contracts are becoming the norm, offering more flexibility to hedgers and attracting speculators who provide the much needed liquidity. Even the CME Group learned it the hard way with some niche commodities.

The SGX rubber futures contract size is just 5 metric tonnes, translating to a point value of only $50. To put this into perspective, the months-long trading range for this contract represented a mere $500 change in contract value! Typical values for some US futures contracts during a comparable period would be several thousand dollars.

Such a small contract size allows traders to utilize their risk management without resorting to excessively tight stop losses. It also enables the trading of multiple contracts even by retail traders, which is necessary for proper money management

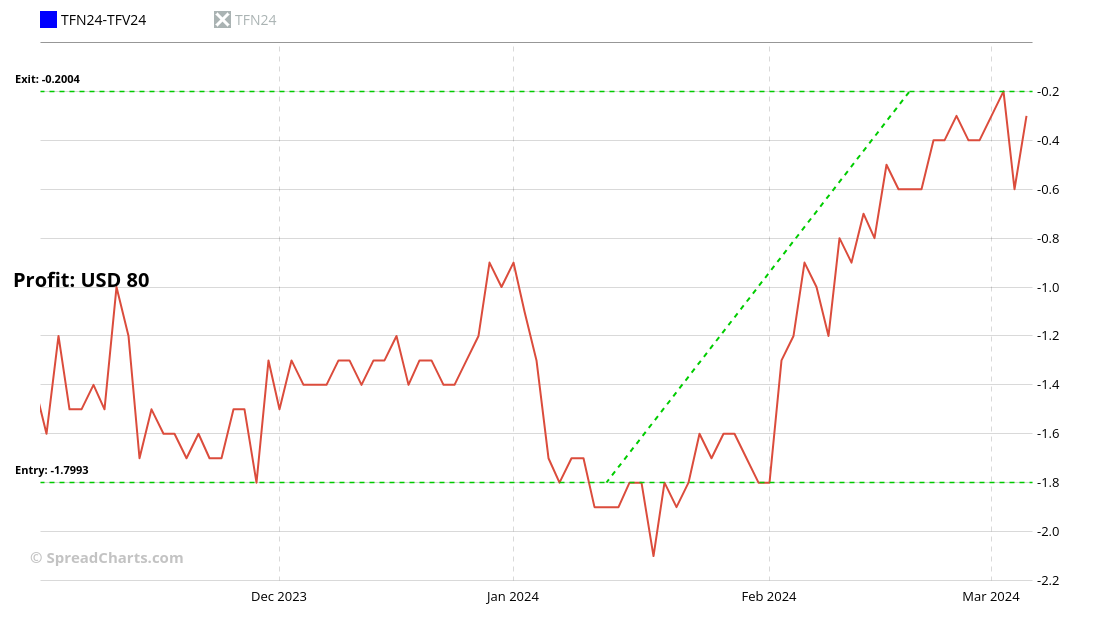

And do you remember that spread on the seasonal chart a few paragraphs above? Its price change over two months is worth just $80!

USD denominated

Despite being traded on the SGX, a Singaporean exchange, the Rubber futures are denominated in US Dollars. This eliminates currency risk for US investors and simplifies margin calculations. And even for traders from other countries, converting money to USD is generally easier than converting to SGD.

I hope you now understand why we’re so excited by adding SGX Rubber data to the SpreadCharts app. Below, we attach full contract specifications for both the TSR20 (synthetic) and RSS3 (natural) contracts.

We were able to sign the license with the SGX and add this new data into the app only thanks to our premium subscribers. If you want to see additional data in the app, consider purchasing the premium subscription.

|

|

|

| Contract name | SGX SICOM TSR20 Rubber |

|

|

|

| Exchange | SGX |

|

|

|

| Ticker | TF |

|

|

|

| Expiration months | F, G, H, J, K, M, N, Q, U, V, X, Z |

|

|

|

| Currency | USD |

|

|

|

| Contract size | 5 metric tonnes |

|

|

|

| Point value | $50 |

|

|

|

| Tick size / value | 0.1 / $5 |

|

|

|

| Settlement | Physical |

|

|

|

|

|

|

| Contract name | SGX SICOM RSS3 Rubber |

|

|

|

| Exchange | SGX |

|

|

|

| Ticker | RT |

|

|

|

| Expiration months | F, G, H, J, K, M, N, Q, U, V, X, Z |

|

|

|

| Currency | USD |

|

|

|

| Contract size | 5 metric tonnes |

|

|

|

| Point value | $50 |

|

|

|

| Tick size / value | 0.1 / $5 |

|

|

|

| Settlement | Physical |

|

|

|

Check out these great articles as well

A major new version of the app is here

Today, we’re excited to show you the major new version of the SpreadCharts app that’s...

Read moreLiberation Day!

Tariffs are arguably the dumbest part of Trump’s agenda. Yes, the goal makes perfect sense,...

Read moreWhy is the Dollar falling when stocks are cratering?

We have received the same question from several of our subscribers over the past week....

Read moreIntroducing the COT small traders

The SpreadCharts app is well known for offering data and features that provide a material...

Read more