How we were right (or wrong) in 2021 and what to expect in 2022

2021 is over, and it’s time to look back and evaluate how our predictions and outlooks turned out. We won’t go through all the opportunities we mention on our twitter or in the videos but focus instead on our quarterly macro outlooks. These are part of the premium version of SpreadCharts and provide a medium-term outlook for major asset classes like stocks or commodities.

New Year’s outlook from the beginning of 2021

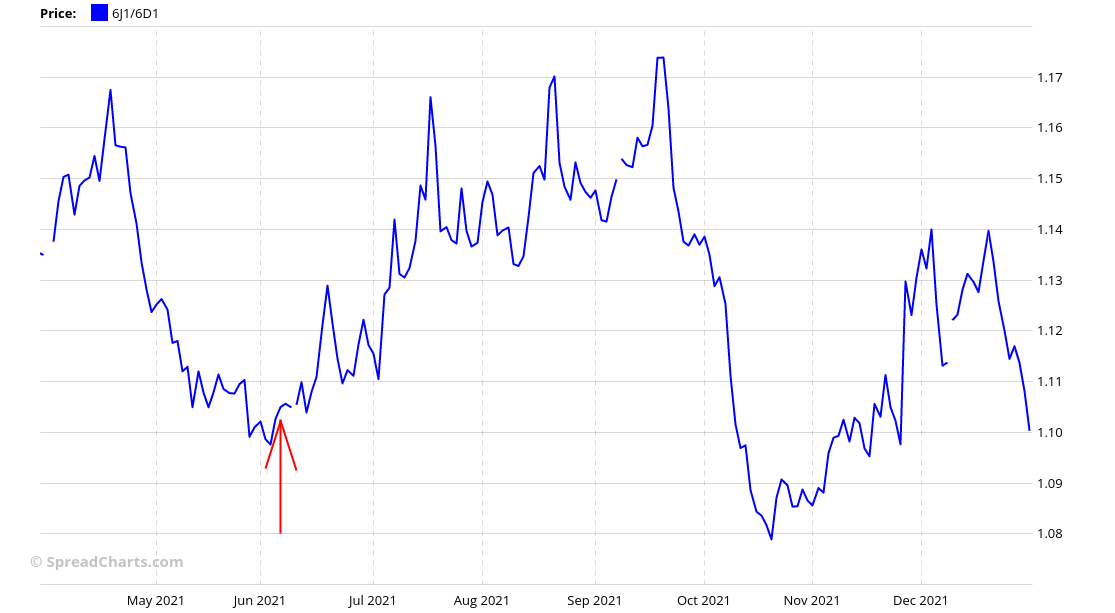

This was our outlook for the stock market from the email we sent to all our users at the beginning of 2021. We were generally bullish but were looking for a major correction sometime in 2021. Of course, it did not come in 2021, so this expectation turned out to be wrong. Luckily, we stuck to the data rather than our opinions, which prevented us from turning tactically bearish throughout 2021.

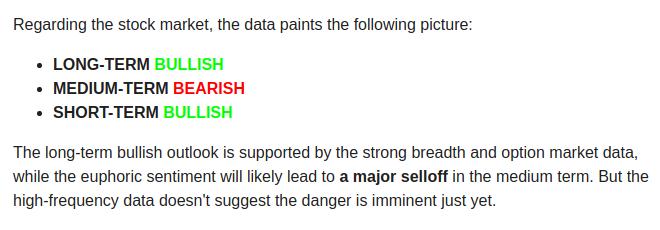

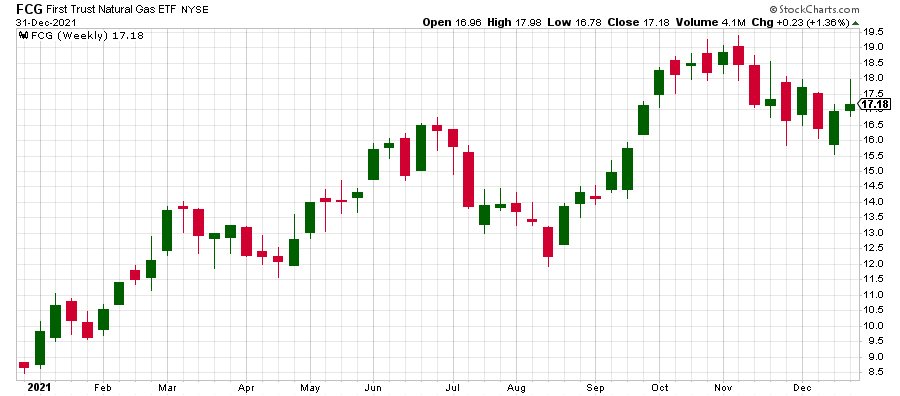

The best opportunity back then, in our opinion, was the natural gas and Canadian oil companies that we already called the opportunities of this decade back in October 2020. They turned out to be among the best performing stock market industries in 2021, basically doubling in price over the year.

Second quarter of 2021

In the second macro outlook at the beginning of April, we continued to be bullish energy in the medium term. We also turned bullish on precious metals like gold and silver. That was spot on as a tremendous, nearly $200 rally began immediately. But while our tactical call on gold was a great success, we were ultimately disappointed by its eventual turn lower in June. We expected more from that market.

We also warned you about China, which probably fell on deaf ears of many BABA dip buyers. But our top pick for that quarter was coffee. We called it a “hidden champion,” and the price has more than doubled since then.

Third quarter of 2021

We adopted an opportunistic strategy in our macro outlook at the beginning of July. While being aware of the worsening stock market breadth, we embraced long Biotech (IBB) at the beginning of June as the industry that would do well in a strong dollar environment. Moreover, we embraced long Nasdaq as we considered the technology sector to be the last source of strength for the internally weakening market. Both ended up being great opportunities.

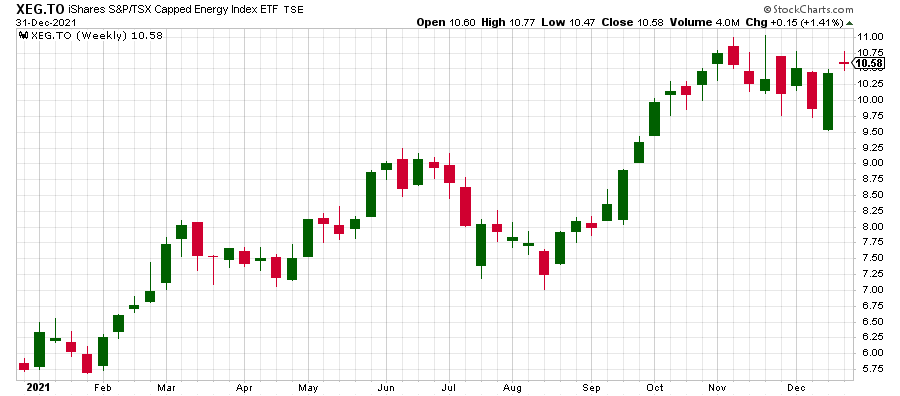

We also expected the bond yields to continue higher, and our top pick (strategy) was JPY/CAD currency pair. That turned out to be less successful than we initially thought. While the JPY/CAD went immediately higher and good money could be made there, it failed to enter the uptrend we hoped for and turned down in the middle of September.

Fourth quarter of 2021

In our last macro outlook at the beginning of October, we warned you about China (again) and showed you the data we watch to consider China to be investable again. People obviously did not listen (again). We also turned medium-term bearish on energy, maybe for the first time since October 2020. We alerted you about the upcoming correction on crude oil multiple times on twitter.

Our stance towards the US stock market became even more defensive but not bearish yet. That’s the reason why we selected the defensive utilities sector as our best pick for the quarter. The result is for all of you to see.

Back to the present

And here we are at the beginning of 2022. How’s our outlook changed since October? Luckily for you, we released a fresh New Year’s outlook today. It is somewhat special as we revealed some of the data that we have not presented anywhere yet. As always, we went from equities through commodities and currencies. In the end, we revealed one stock market sector that might become a great opportunity in 2022 (probably in its 2nd half).

The macro outlook is part of the premium version of SpreadCharts that you can get in the app or on this website here. Don’t miss this if you want to get the same advantage in the markets as our users in 2021!

Check out these great articles as well

New data: Sector indices

Our software is already established well beyond commodity market analysis. Stock indices, currencies, and even...

Read moreWhat’s new in the SpreadCharts app?

It’s been a few months since we launched the new version of the SpreadCharts app....

Read moreA major new version of the app is here

Today, we’re excited to show you the major new version of the SpreadCharts app that’s...

Read moreLiberation Day!

Tariffs are arguably the dumbest part of Trump’s agenda. Yes, the goal makes perfect sense,...

Read more