New data: Currencies

The first batch of new data is coming to the SpreadCharts app, as we promised. As the title of this blog post suggests, it will be currencies.

Specifically, these currency futures have been added:

- CME Mexican Peso MXN

- CME Brazilian Real BRL

- CME South African Rand ZAR

- CME Indian Rupee/USD INR

- CME Standard-Size USD/Offshore RMB

- CME Polish Zloty PLN

- CME Russian Ruble RUB

You can find their tickers in the app when you roll out the Currencies group.

While this is obviously great news for currency traders, the utility of this data goes far beyond. Many commodities like gold, oil or copper are in demand globally. Yet, their pricing mostly happens in US Dollars due to its global reserve status. For example, Europeans are interested in gold priced in Euros, not US Dollars. If its price in Euros gets too high, their demand cools off, even though gold priced in Dollars may still be cheap. So it does make sense to watch the prices of these global commodities in other currencies. Speaking about our example, you can watch gold price in Euros per kilo in the chart below:

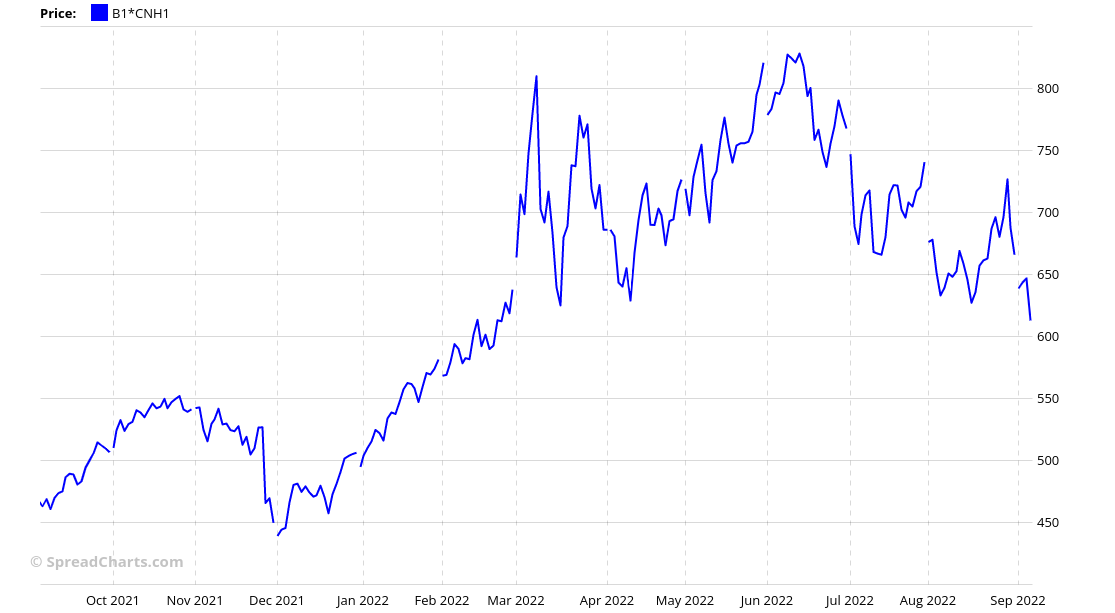

Adding these emerging market currencies is especially important today. China is a top global consumer of many commodities. Below is Brent crude oil futures priced in Yuan. And it’s not just some artificial time series. Chinese are well known for opportunistically filling their SPR if they consider the price of crude oil to be low. Therefore, it’s important to be able to view the market from their perspective.

Check out these great articles as well

New data: Sector indices

Our software is already established well beyond commodity market analysis. Stock indices, currencies, and even...

Read moreWhat’s new in the SpreadCharts app?

It’s been a few months since we launched the new version of the SpreadCharts app....

Read moreA major new version of the app is here

Today, we’re excited to show you the major new version of the SpreadCharts app that’s...

Read moreLiberation Day!

Tariffs are arguably the dumbest part of Trump’s agenda. Yes, the goal makes perfect sense,...

Read more