Quick coffee trade idea

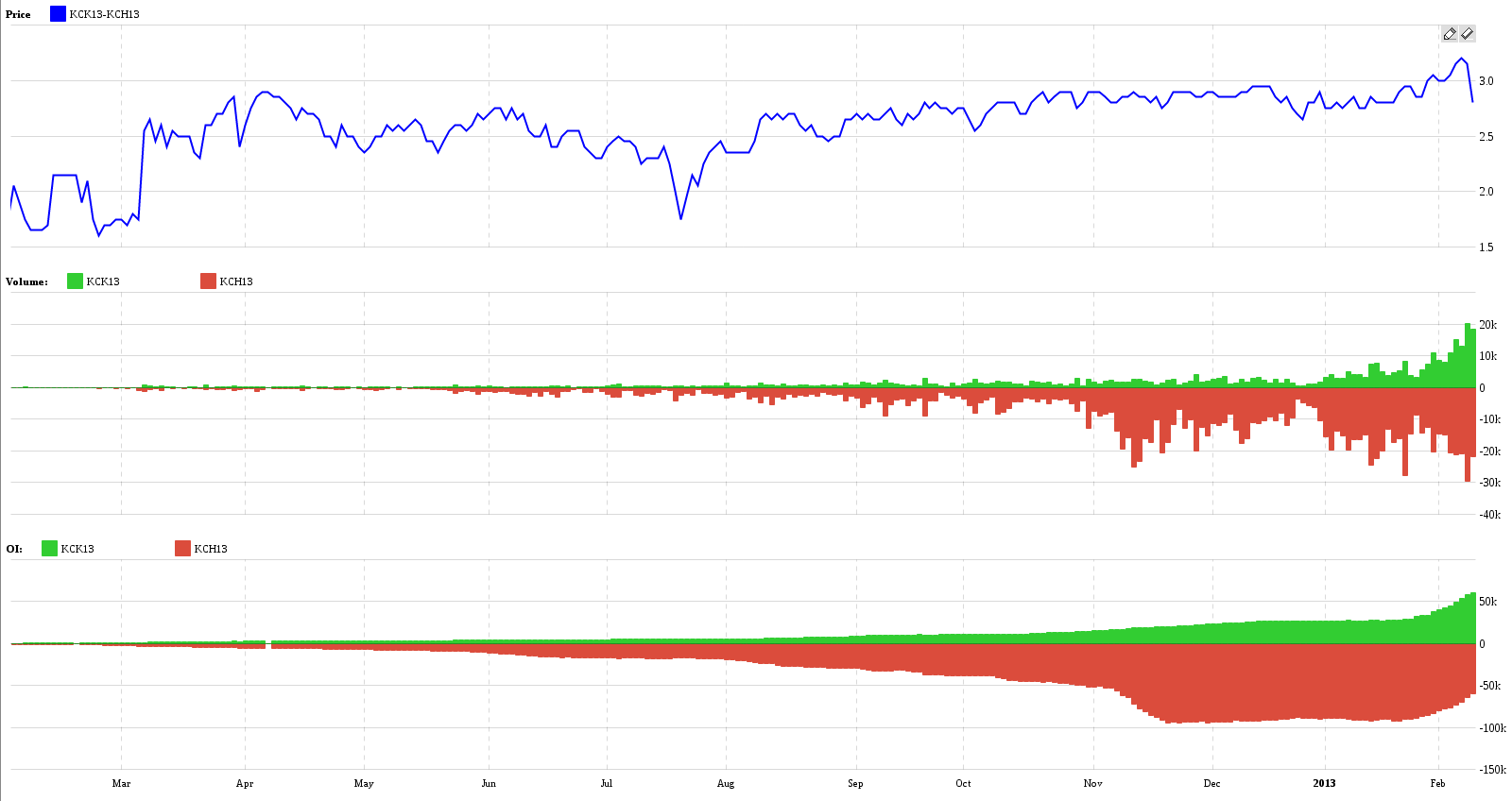

One quick trade in NYBOT coffee (KC). Look at the spread KCK13-KCH13:

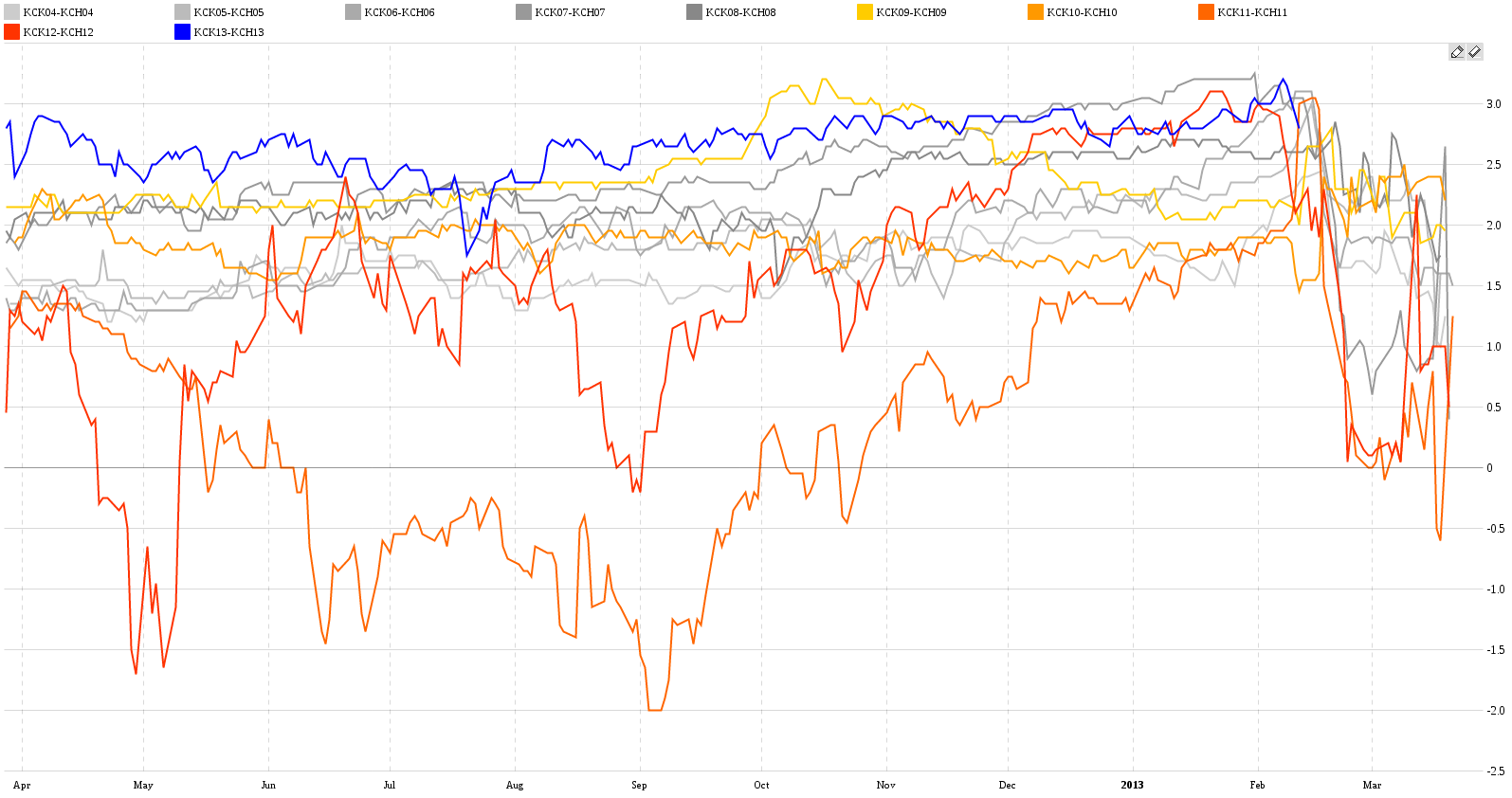

Shorting the spread (i.e. long KCH13, short KCK13) would be a good idea right now. Why? Look at the seasonality analysis of this spread:

It never gets much over 3.0 in the last ten years so there is probably an arbitrage barrier. And it tends to decline towards parity before expiration. However, the front contract is expiring soon so keep in mind the risk! First notice day for KCH13 is Feb 20th so this is a very short-term trade. If the spread won’t move in few days, I’d get away. Don’t wait for FND to be liquidated – coffee can be brutal when you have an unhedged futures position.

Liquidity seems to be good for now. Front open interest is already declining but volume is still at safe levels around 20k. But keep an eye on it.

Check out these great articles as well

A major new version of the app is here

Today, we’re excited to show you the major new version of the SpreadCharts app that’s...

Read moreLiberation Day!

Tariffs are arguably the dumbest part of Trump’s agenda. Yes, the goal makes perfect sense,...

Read moreWhy is the Dollar falling when stocks are cratering?

We have received the same question from several of our subscribers over the past week....

Read moreIntroducing the COT small traders

The SpreadCharts app is well known for offering data and features that provide a material...

Read more