How do ETFs work?

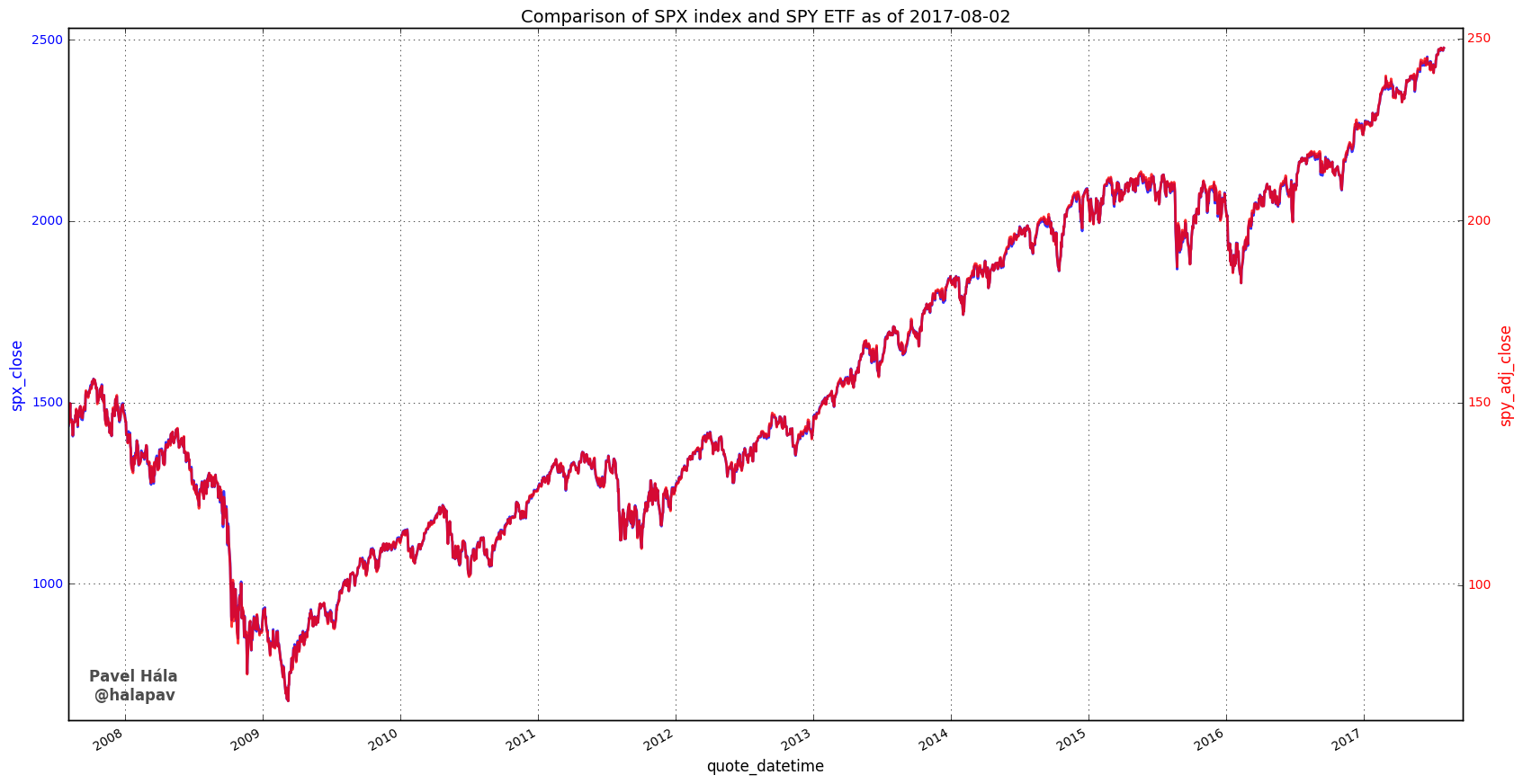

I described how ETFs are a convenient way to trade an index, for example the S&P 500. The question is, how good is ETF in tracking the underlying index? Well, it’s damn good! Take a look at the next chart which is comparing price of the S&P 500 index (blue, left axis) and the derived SPY ETF (red, right axis) during the last 10 years.

Outstanding shares

The lines match perfectly. You can barely see the blue line (index) behind the red line (ETF). How’s possible such a close connection? Technically, the ETF itself is a standalone product. What happens when a huge buy/sell order comes in? After all, the ETF trades like a stock on a stock exchange. All of us know about countless examples when a single stock was pushed way from its sector counterparts by speculative buying/selling. The key difference between stocks and ETFs is in outstanding shares, i.e. the number of shares a company or fund has issued. It may suddenly increase for example when a company need to raise money by issuing new shares or when employees exercise stock options or warrants. This process is known as dilution, because it dilutes holdings of existing shareholders. However these changes usually don’t happen every day, so the number of outstanding shares is about the same in short term horizon.

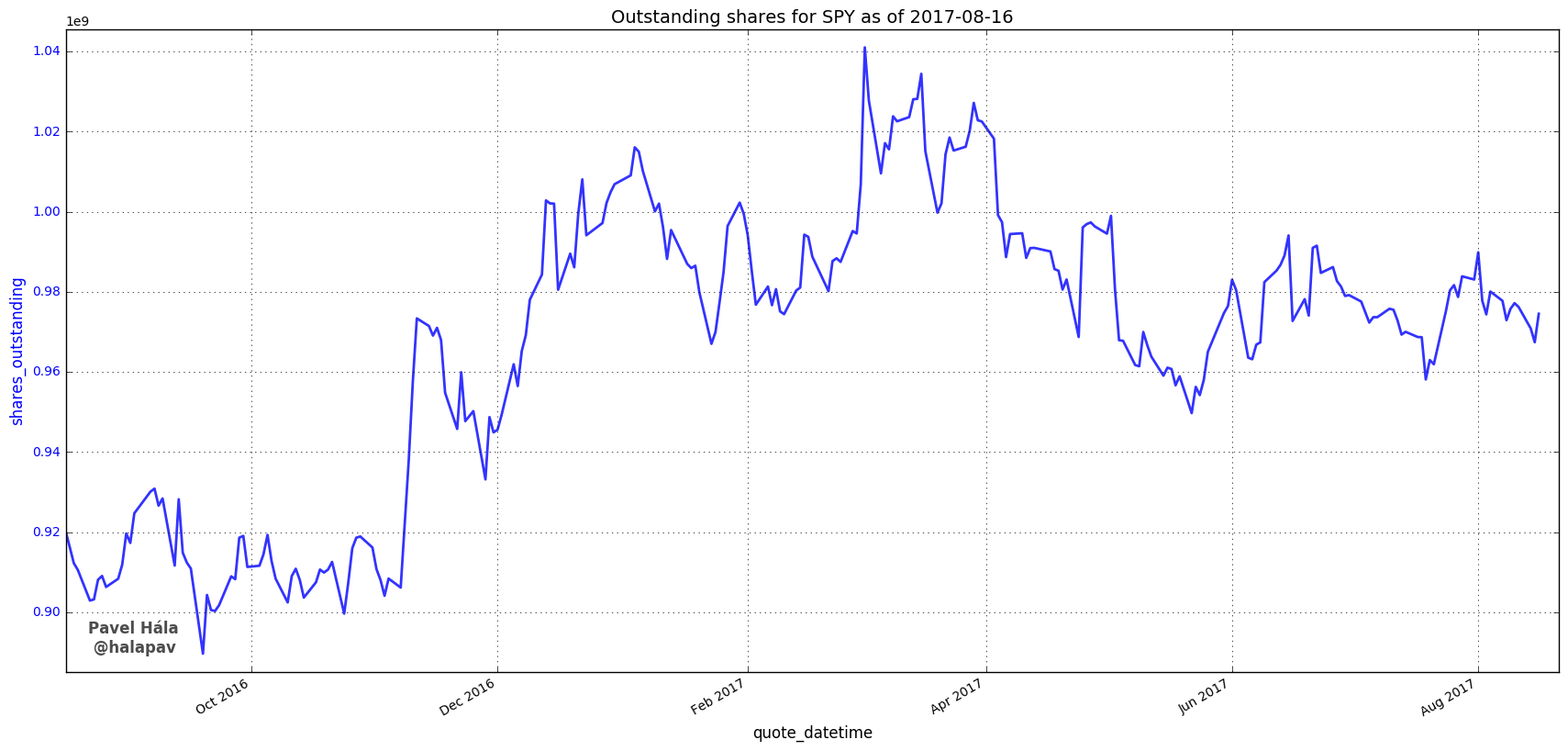

Unlike stocks, ETF’s number of outstanding shares can change significantly from day to day. As I’ll describe below, this is a pretty important detail. It keeps the price of ETF in balance with supply and demand forces.

Authorized participants and the creation/redemption mechanism

There is a mechanism that ensures price stability of an ETF. It’s performed by so-called authorized participants (APs). These are basically market makers, which means institutions like investment banks, prop trading firms and big hedge funds. They have very low trading commissions. Every ETF has a so-called creation unit specified in its prospectus. It is the smallest block of ETF shares, that can be redeemed with the fund’s administrator for the underlying assets the fund holds (individual stocks, bonds, futures, etc.). It also works the other way. The underlying assets (stocks, futures that ETF holds) can be exchanged with the fund’s administrator for creation units, i.e. blocks of ETF shares (typically 50000 pcs).

Every day the administrator publishes value and composition of all the assets the fund holds. The NAV (net asset value) is then calculated out of these data. It’s basically summed assets less liabilities divided by number of outstanding shares. It tells us what the fair price of one ETF share really is. The price stability of ETF during the day is then secured by arbitrage trades made by the APs. When there is a huge demand for the ETF, it’s price can slightly rise above the NAV, meaning it’s trading with a premium to value of the fund’s assets. If this difference widens above a certain threshold, APs buy cheap underlying assets on the open market (stocks, futures) in sufficient quantity, exchange them with the fund’s administrator for creation units, and then sell blocks of these ETF shares on the market.

Similarly, when people are getting rid of the ETF too fast, the price of the ETF may fall below the NAV. APs start buying cheap ETF shares, make creation units out of them and then exchange them with the fund’s administrators for the underlying asset the fund holds (stocks, futures). These assets are then sold on the market. This mechanism not only ensures price stability, it also regulates amount of outstanding ETF shares in circulation. The creation/redemption of new ETF shares makes it very responsive to the offer/demand for the ETF, and share count is not dependent on any artificially set rule.

Algorithmic market making

Needless to say, the way APs deal in the market is fully automated. It’s very fast and is performed by algorithms, rather than real people. APs themself are competing with each other. They try to exploit even the tiniest inefficiencies as fast as possible. I witnessed it myself back when I was working in asset management. I was closing a huge position in UNG (ETF on natural gas). This position was big, many times larger than ordinary intraday volume. Still, I have not been able to move price of the ETF due to the arbitrage by the APs. My trading activity almost instantly propagated into futures market, where the market depth is magnitudes higher compared to UNG.

Check out these great articles as well

A major new version of the app is here

Today, we’re excited to show you the major new version of the SpreadCharts app that’s...

Read moreLiberation Day!

Tariffs are arguably the dumbest part of Trump’s agenda. Yes, the goal makes perfect sense,...

Read moreWhy is the Dollar falling when stocks are cratering?

We have received the same question from several of our subscribers over the past week....

Read moreIntroducing the COT small traders

The SpreadCharts app is well known for offering data and features that provide a material...

Read more