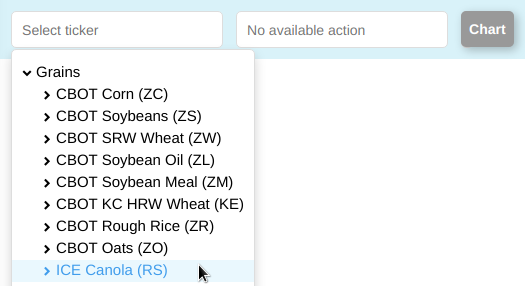

New data: ICE Canola

We plan to widen the scope of our data offerings in the future. And we are starting today with the very important oilseed, which is canola.

Canola is processed into vegetable oil, animal feed, and lately biofuels, especially biodiesel.

It trades on the US venue of the Intercontinental Exchange under the ticker RS. One key difference against most ICE US commodities is that the canola contract is denominated in Canadian dollars. We summarized the most important information in the following table:

|

|

|

| Contract name | Canola futures |

|

|

|

| Exchange | ICE US |

|

|

|

| Ticker | RS |

|

|

|

| Expiration months | F, H, K, N, X |

|

|

|

| Currency | CAD |

|

|

|

| Contract size | 20 tons |

|

|

|

| Point value | C$20 |

|

|

|

| Tick size / value | 0.1 / C$2 |

|

|

|

Check out these great articles as well

A major new version of the app is here

Today, we’re excited to show you the major new version of the SpreadCharts app that’s...

Read moreLiberation Day!

Tariffs are arguably the dumbest part of Trump’s agenda. Yes, the goal makes perfect sense,...

Read moreWhy is the Dollar falling when stocks are cratering?

We have received the same question from several of our subscribers over the past week....

Read moreIntroducing the COT small traders

The SpreadCharts app is well known for offering data and features that provide a material...

Read more