Selection from trading signals

New trading signals were added to the app yesterday, in line with the schedule. As always, we immediately let you know on twitter. We use the same channel to select a few signals that caught our attention. This time, however, we decided to do so in this article.

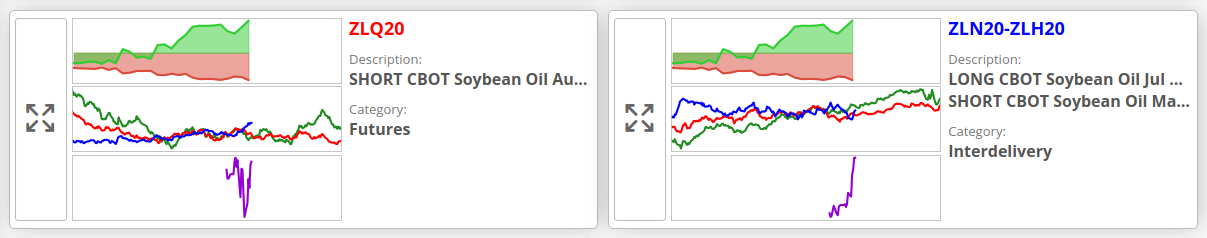

Soybean oil: time for a change?

Our AI trading model has been long on soybean oil until recently. Yesterday a new short signal on soybean oil emerged in the app. The strength of the signal is rather weak as it is below the 1.0 threshold necessary for a valid signal. And don’t get confused by the similar strength of the current short signal at the beginning of December – there was an opposite signal with much higher strength back then. However, it’s the new bear spread in soybean oil that is much more interesting than the underlying. In this case, the signal is strong enough and, therefore, valid.

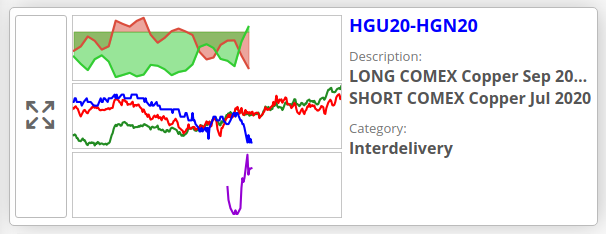

Turnaround in copper

The AI model has been consistently long copper and its bull spreads over the last few months. Moreover, it was one of the major opportunities we accented in our premium Research. It turned out to be a very successful strategy. Nevertheless, the situation seems to be changing. The long signal for copper disappeared yesterday as it is too weak (below 0.8 for many days) to be present in the app. On the other hand, a new bear spread in copper has emerged. Unfortunately, it’s still quite weak (below 1.0). The overall situation looks like a tactical pause in the current uptrend, rather than a sudden turnaround. This is also in line with our own opinion.

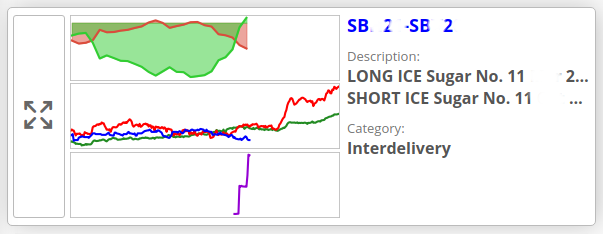

First signal in sugar

If I’m not mistaken, this is the first time since the launch of the AI trading signals when a signal for sugar appeared in the app. Specifically, it’s a spread. After a closer look, we have to conclude it’s a very interesting opportunity. Check it out yourself in the SpreadCharts app.

A few words at the end

These were just a few signals that immediately caught our attention. You’ll find many more in the app, so maybe you’ll prefer something else.

The opportunities are out there, as you can see. But keep in mind we’re entering the holiday season when the markets are less liquid. The prices tend not to move much, and bid/ask spreads can widen, which is especially true for more distant contracts and commodity spreads.

So what is the best strategy for the upcoming period? Well, in our opinion, it would be wise to take a break from the markets. It doesn’t make sense trading in such a low liquid environment. The markets usually pick a clear direction after the New Year and disregard the price action over the holidays. Don’t fear you would miss anything. And even if you do, there will always be plenty of opportunities in the commodity markets, which is their greatest advantage.

The whole SpreadCharts team wishes you a merry Christmas and happy New Year.

Trading signals are generated by a complex machine learning model and are not intended for actual trading. Trading signals are intended for educational purposes only. SpreadCharts s.r.o. (the company) or its representatives bear no responsibility for actions taken under influence of the trading signals or any other information published anywhere on this website or its sub-domains. There is a risk of substantial loss in futures trading.

CFTC Rule 4.41: Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs, in general, are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown. All information on this website is for educational purposes only and is not intended to provide financial advice. Any statements about profits or income expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed. You accept full responsibilities for your actions, trades, profit or loss, and agree to hold SpreadCharts s.r.o. (the company) and any authorized distributors of this information harmless in any and all ways.

Check out these great articles as well

A major new version of the app is here

Today, we’re excited to show you the major new version of the SpreadCharts app that’s...

Read moreLiberation Day!

Tariffs are arguably the dumbest part of Trump’s agenda. Yes, the goal makes perfect sense,...

Read moreWhy is the Dollar falling when stocks are cratering?

We have received the same question from several of our subscribers over the past week....

Read moreIntroducing the COT small traders

The SpreadCharts app is well known for offering data and features that provide a material...

Read more