Soybean oil spread with great profit potential

Today I have one more volatile (and therefore risky) spread. But despite volatility, this trade still has a very good RRR (risk reward ratio). The trade I’m talking about is the soybean oil interdelivery spread ZLZ13-ZLN13:

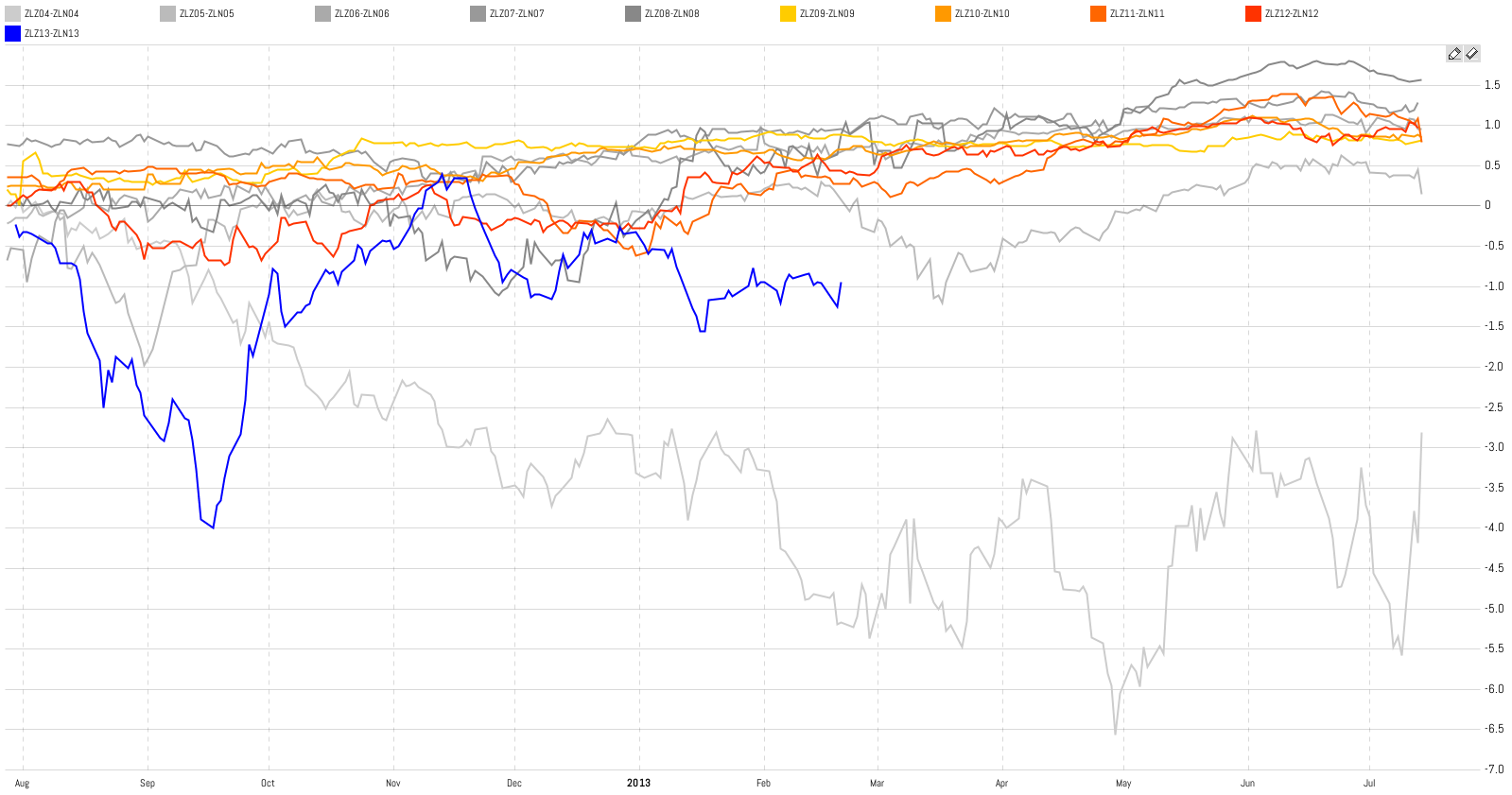

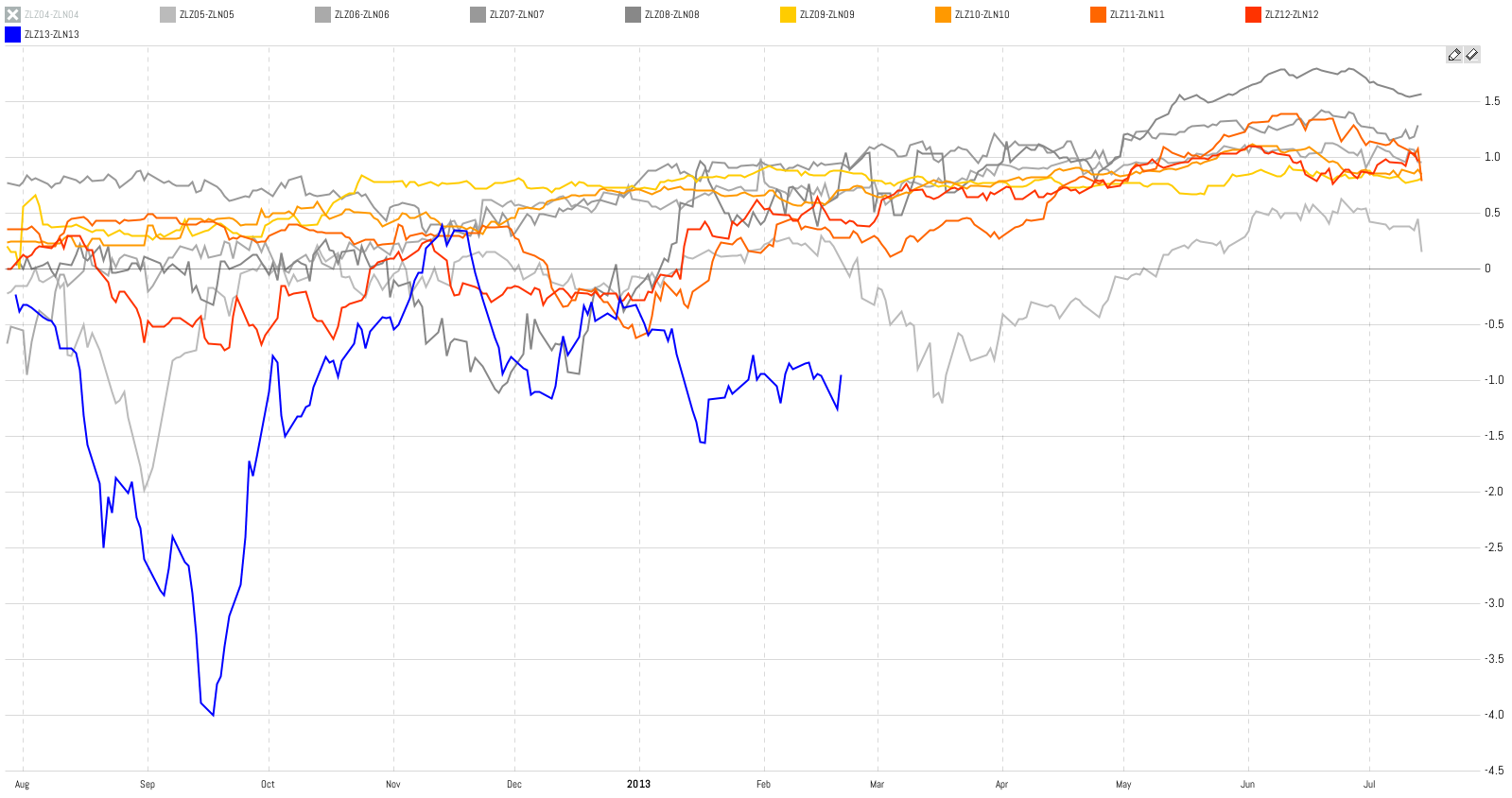

Based on the picture above the technical setup is not great but still favorable. Price seems to have found a base between -1.5 and -1.0. More important here is the seasonal setup as you can see in this study on app.spreadcharts.com:

ZLZ04-ZLN04 is an abnormal year. Take it as a warning that nothing is sure even in spread trading. But for our cause, it’s better to hide this year by clicking on it in the legend. We get this picture:

I think the seasonal trend is clearly visible now. The spread usually expires near 1.0. Given the current price, it gives us a nice profit potential of $1200 per contract. Which is nice.

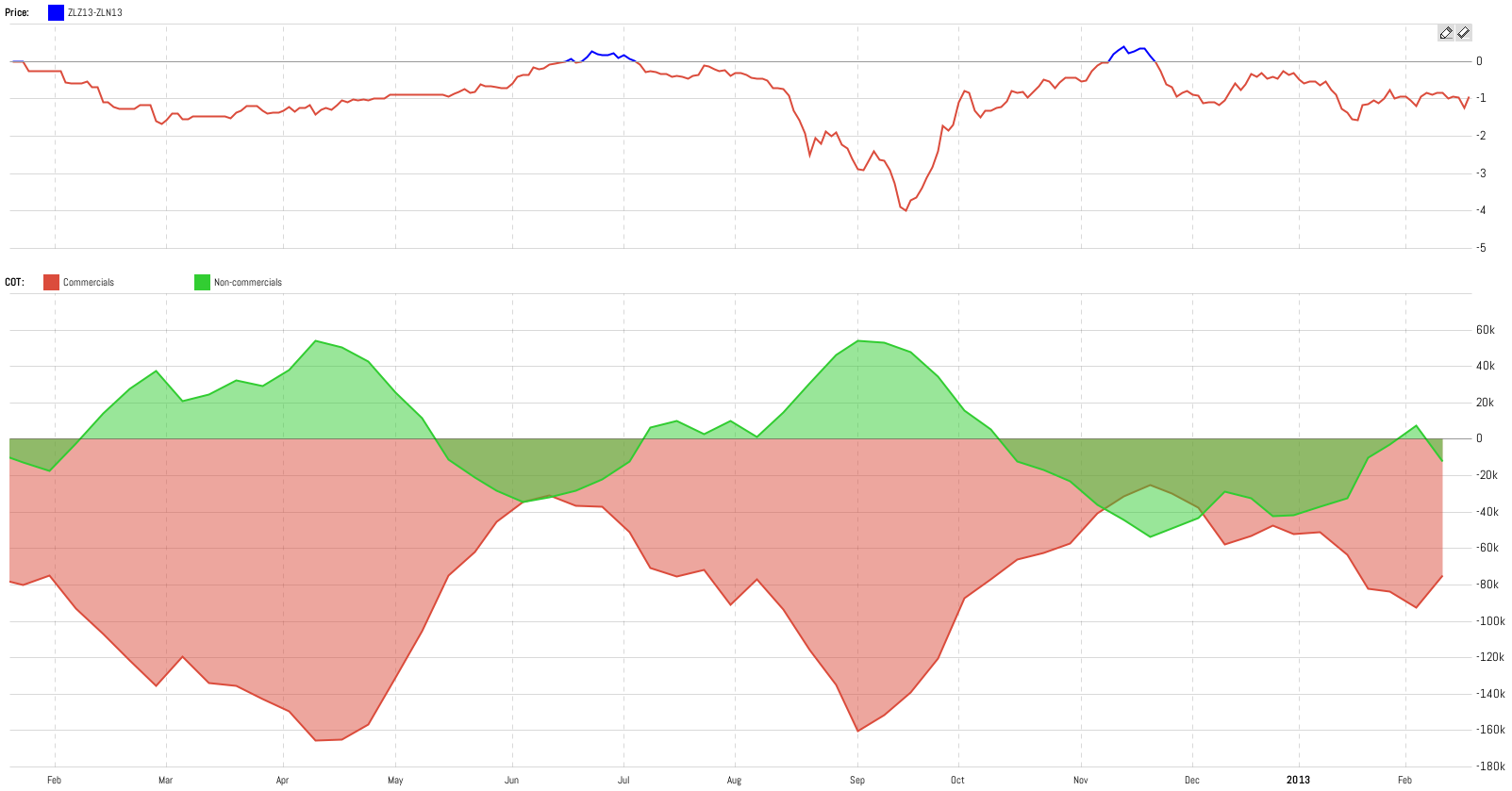

Maybe I haven’t mentioned it in this blog yet but the Commitments of Traders is a great tool in commodity futures and spread trading. Especially interdelivery spreads are great for deploying this tool. Our app has a comprehensive Commitments of Traders analytics tool. So let’s take a look:

This is not a time to write about COT (I will do it later) but even if you don’t know what the COT is you should clearly notice the correlation between the price and corresponding Commercial and Non-commercial position curves. Simply said the current COT position distribution is not as good as it was in September of last year but still quite favorable for this trade.

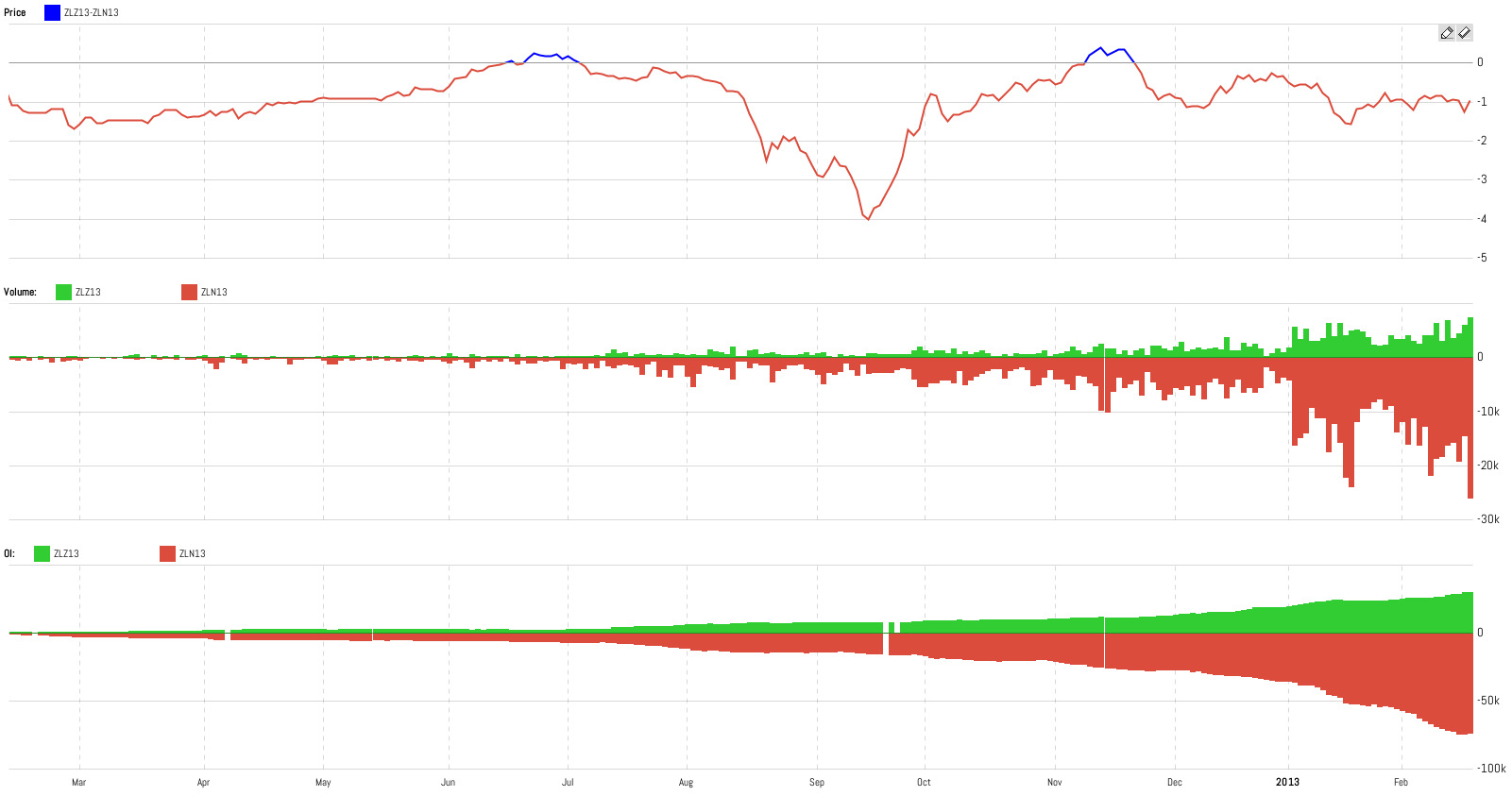

The last thing is liquidity which is great for both legs of the spread:

Check out these great articles as well

A major new version of the app is here

Today, we’re excited to show you the major new version of the SpreadCharts app that’s...

Read moreLiberation Day!

Tariffs are arguably the dumbest part of Trump’s agenda. Yes, the goal makes perfect sense,...

Read moreWhy is the Dollar falling when stocks are cratering?

We have received the same question from several of our subscribers over the past week....

Read moreIntroducing the COT small traders

The SpreadCharts app is well known for offering data and features that provide a material...

Read more