Sugar reversal

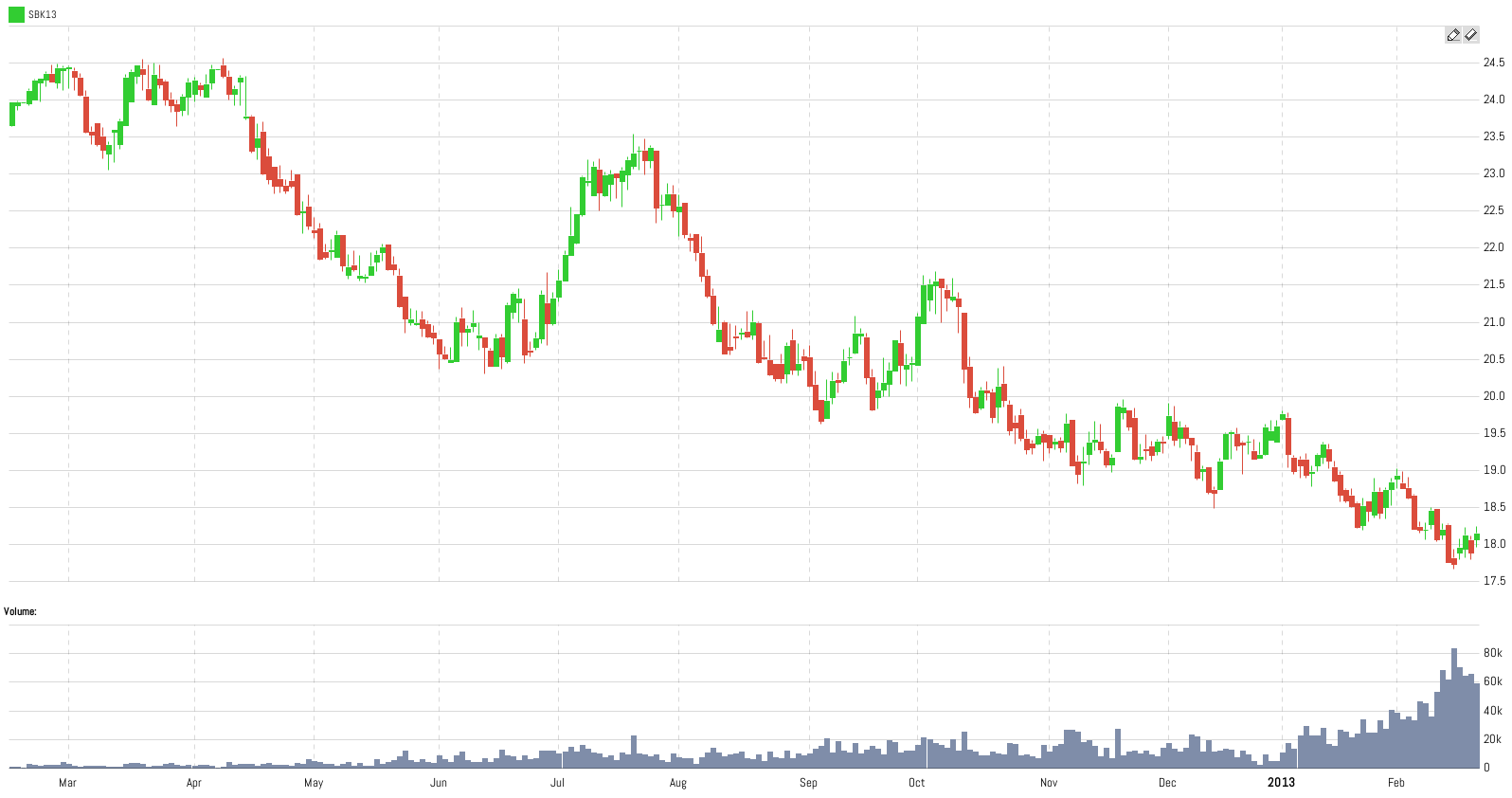

Sugar has been in a downtrend for quite some time. I think this is about to change. This is the daily OHLC chart from app.spreadcharts.com:

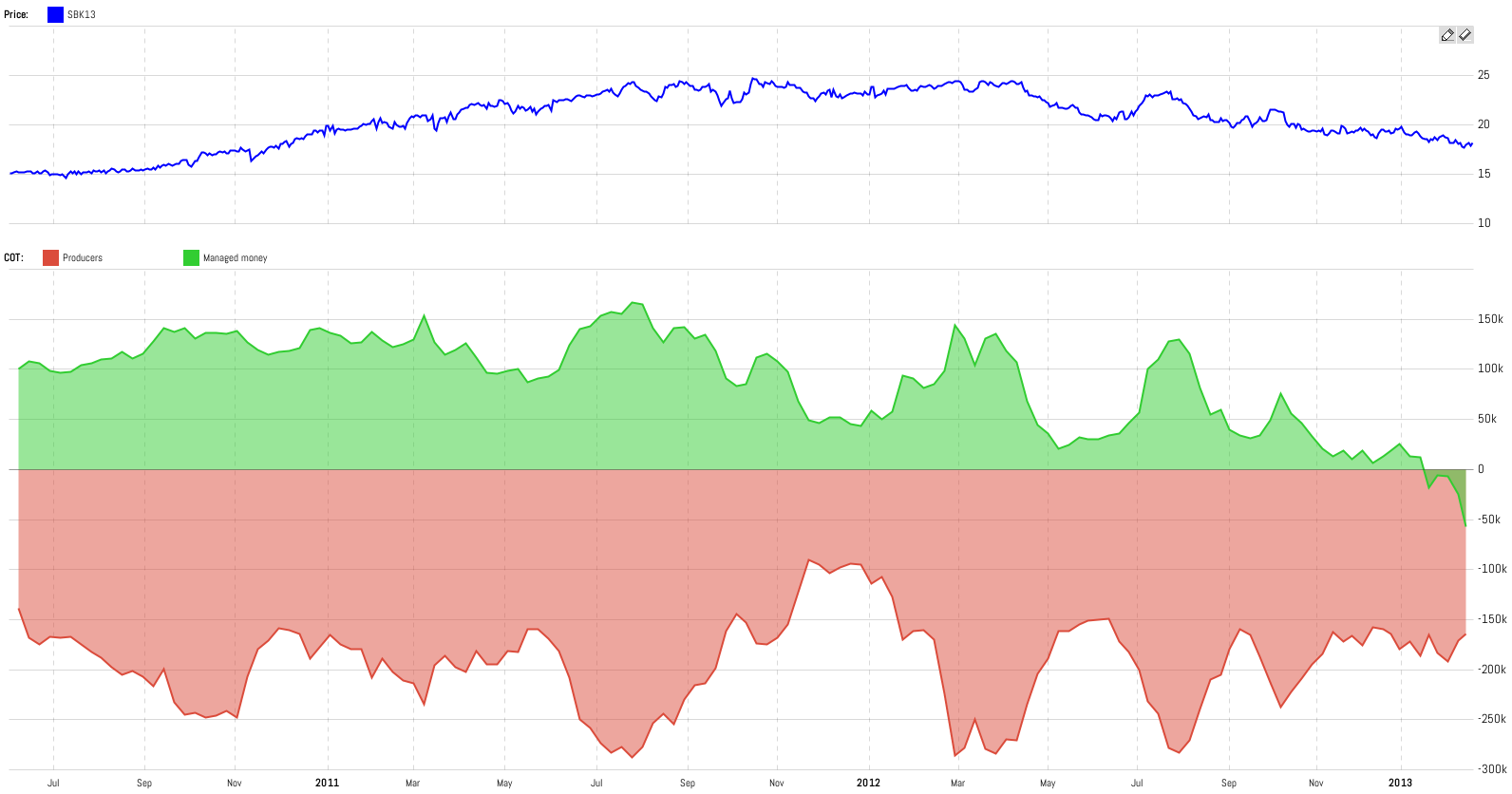

Yep, no sign of a turnaround. So why do I think this may happen? Because of the internal structure of the market, i.e. distribution of futures positions between particular market participants. Simply said, I’m talking about the Commitments of Traders (COT). The next study shows the COT absolute positions chart:

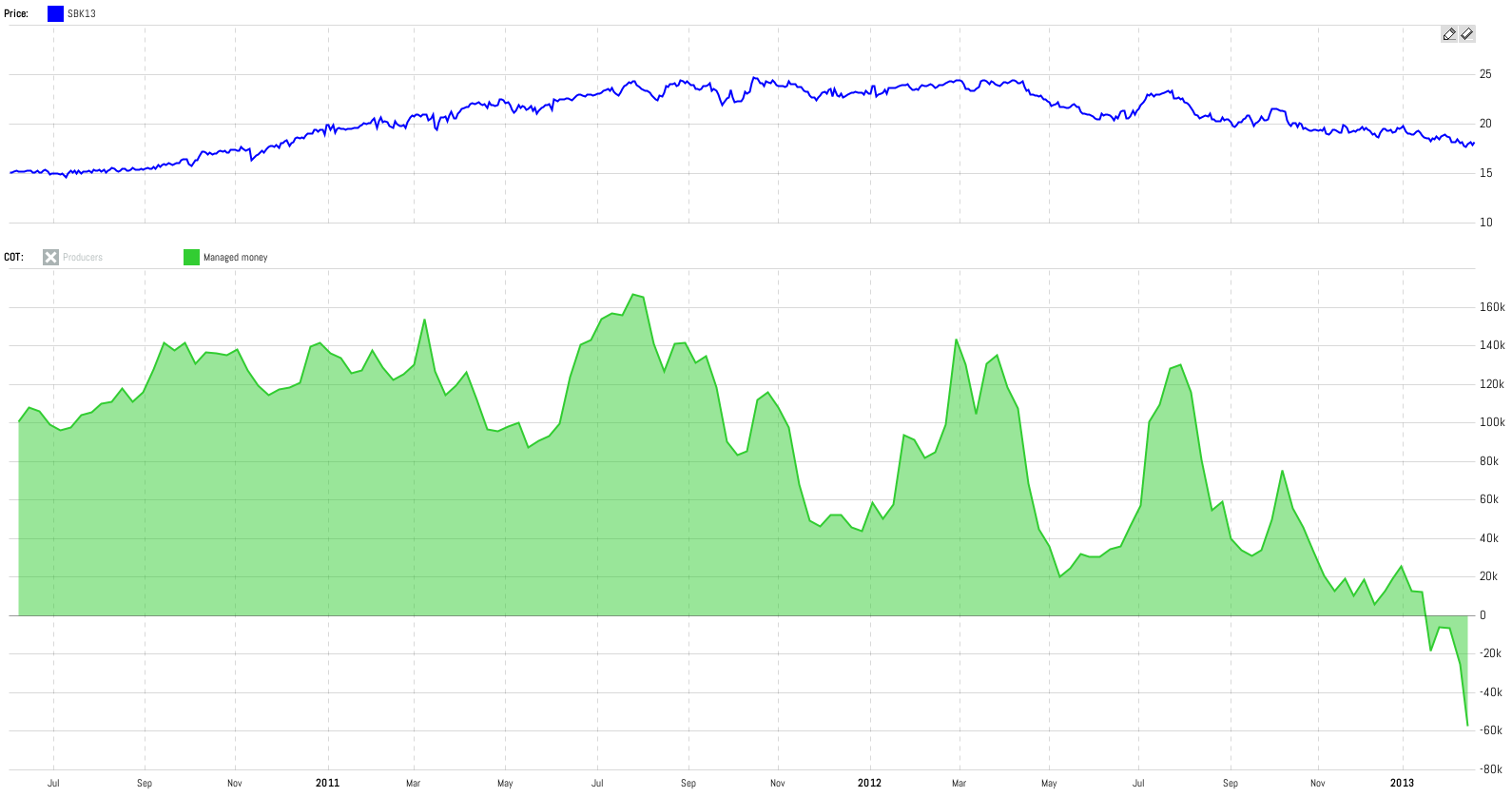

Let’s explain it a little bit. The red line is composed of net positions (long – short) of producers, mercs, processors. These people are hedgers, they come to market to hedge their risk, not to speculate. On the other hand, the green line represents positions of money managers, i.e. large speculators. Both of these groups have a large influence on the market. Look at managed money only:

It has a positive correlation with price. And it recently turned negative which is very unusual in the sugar market. And very bullish.

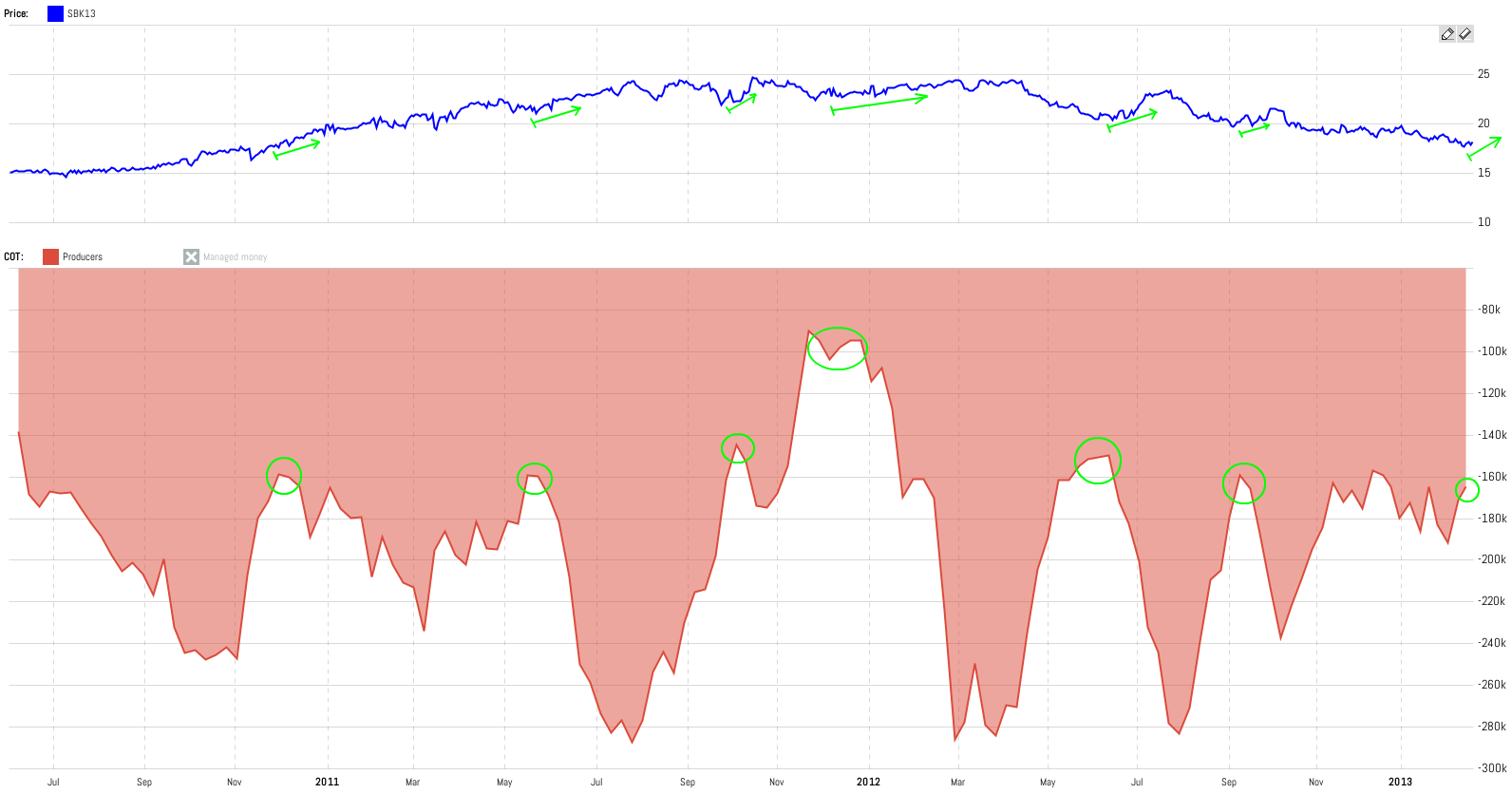

An even more important group is producers etc. To make it even more obvious I highlighted certain point in this study:

Remember these people are hedgers. Therefore, the position curve has an inverse correlation with the price. I marked the turnaround points. It’s interesting that those turnarounds in hedgers positions trend (and therefore price) happen near the same level which is -150k. And this is the level we are approaching now. And I think that’s exactly the reason why we will see a reversal from the current downtrend.

Check out also these great articles

Did you catch the move in Bitcoin?

Have you made money on this incredible move in Bitcoin? Well, you should have. On...

Read moreInsights from the iron ore market

After explaining why Rubber futures can be a great market for traders, we will focus...

Read moreWhy trade SGX Rubber?

Last time, we introduced the SGX data in the SpreadCharts app and briefly described the...

Read moreIntroducing commodities in Singapore

We are thrilled to announce that we have obtained a license to distribute market data...

Read more