There won’t be fresh COT data anytime soon

Everyone who trades commodities or futures on currencies, indices or volatility knows that there haven’t been published any new Commitments of Traders data from Dec 22nd, 2018 to Jan 25, 2019 due to the US government shutdown. We informed you in time about this on our twitter.

Don’t look for new COT data in the app after today’s close. The CFTC won’t publish any new data until the US government shutdown is over.

— SpreadCharts.com (@SpreadChartsCom) December 28, 2018

COT data is a helpful tool for many traders, from small individual investors up to portfolio managers in hedge funds, banks or prop trading firms. All of us were undoubtedly excited about reopening of the federal government this week. This is true also for the CFTC, the federal regulator of futures markets and publisher of the Commitments of Traders report. Together with other people in the commodity business, I was expecting the agency to resume publishing fresh data and gradually release the old missing data over time. Well, we were all wrong.

According to the recent press release, the CFTC will publish the old data first. To be precise, the data that should have been published on Dec 28th, 2018 will be published this Friday, Feb 1st, 2019. The rest of the data will be gradually published in the coming weeks, starting with the oldest data. In order to catch up with the present timeline, the COT report will be published twice a week, on Tuesday and Friday, until all the old reports get released. If I calculate it correctly, we shall get the first fresh, undelayed issue of the COT data on Friday, Mar 8th. That’s more than a month away from now.

COT data aggregation is an automated process in these days for all the reporting subjects. I therefore wonder why it will take CFTC so long to release all the data. Maybe there are some law and regulatory aspects in the process we don’t know about. On the positive side, the delay of the COT data you can see on SpreadCharts will gradually decrease.

P.S.

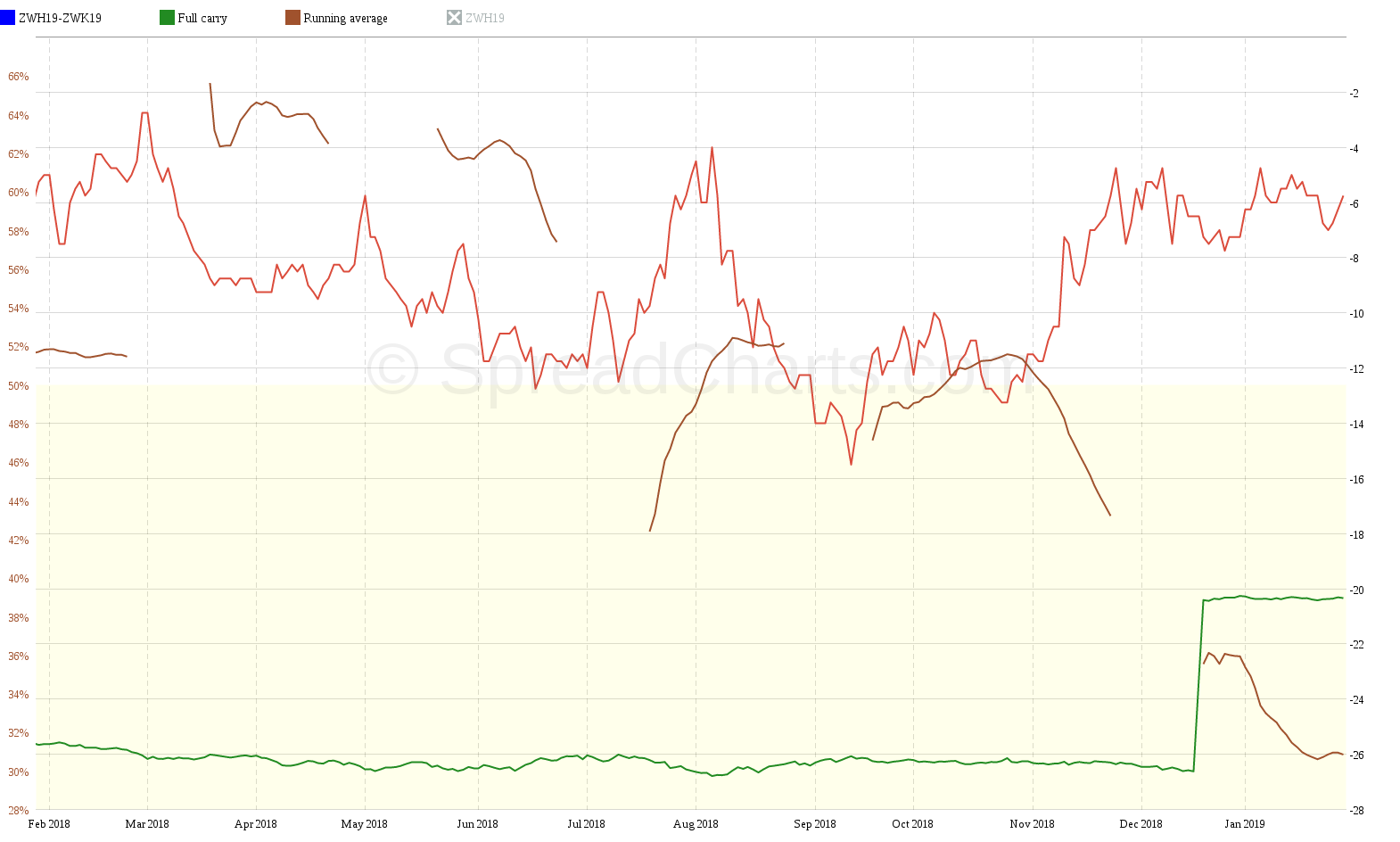

Although the lack of fresh COT data is unfortunate, it’s just one part from the analytical toolbox in the SpreadCharts app. We can find some great opportunities even without COT. Take grains for example. We opened a position in CBOT wheat bull spread this week.

We opened a new position in wheat bull spread ZWH19-ZWK19. We analyzed this opportunity in the last Spread report #ZW_F #wheat #OATT pic.twitter.com/0KaFHLi1hJ

— SpreadCharts.com (@SpreadChartsCom) January 29, 2019

The carrying charges analysis suggest that current running average will finish below 50% of the full carry and we get a storage rate cot for wheat. In that case, the rate would drop to the ground level of 0.165 cents per bushel per day. That can start pushing bull spreads higher which would turn our spread into profit. We analyzed this opportunity in detail in the latest issue of the Spread report.

Check out these great articles as well

New data: Sector indices

Our software is already established well beyond commodity market analysis. Stock indices, currencies, and even...

Read moreWhat’s new in the SpreadCharts app?

It’s been a few months since we launched the new version of the SpreadCharts app....

Read moreA major new version of the app is here

Today, we’re excited to show you the major new version of the SpreadCharts app that’s...

Read moreLiberation Day!

Tariffs are arguably the dumbest part of Trump’s agenda. Yes, the goal makes perfect sense,...

Read more