Commodity spreads 12: How to profit in sideways market?

You may think that this is not possible when you are reading the headline of this article. Something that does not move cannot make you money. However, it is indeed possible, when it comes to interdelivery spreads. Of course, it is necessary to fully understand the principle of spread behavior as well as the structure of the market.

If you have well understood the previous parts of our spread series, you may already know where I am heading to. In the article about spot price, I have revealed the principle of spread movement. Let’s remind us a part of it.

Spot price

The spot price is the price of the commodity with immediate delivery. The term structure acts as a magnet. Therefore, it attracts the closer contracts more. This means that when the spot price rises, usually the nearest contracts are rising more than the others. When the spot price falls, the closer contracts are falling more than the others.

Good. But what if the spot price does not move up or down? In other words, the market moves nowhere.

As I have already written, the spot price is the price of some commodity with immediate delivery. No storage costs are therefore included here. In the normal market, when nothing special happens, the more distant contracts are more expensive (the market is in contango). Storage costs play a role here.

However, if the spot price does not move, contracts must gradually move closer to the term structure, i.e. they converge to the spot price. The closer we are to the expiration, the lower are the storage costs associated with each contract. Therefore, the difference between the spot price and the futures price gradually shrinks.

Do you remember the connection with the magnet? The nearest contracts are pulled to the spot price fastest. And by the way, we’re still talking about contango here. Therefore, the spreads between contracts are widening over time without the spot price moving in any direction.

What spread we should choose?

Bear spread or bull spread? Imagine a situation where the market is in contango and the spot price moves in a narrow price range over a few weeks or months. At this time, a closer contract (let’s say, December contract for corn) gradually converges to the spot price. However, it converges faster than a more distant contract (for example, a March contract for the following year).

Does it remind you something? If not, return to this part. When we expect a closer contract to decline faster than a more distant one, we are choosing the bear spread strategy. This means that we sell the near contract and we buy the more distant one for hedging purposes. In our example, it is the ZCH19-ZCZ18 spread in corn.

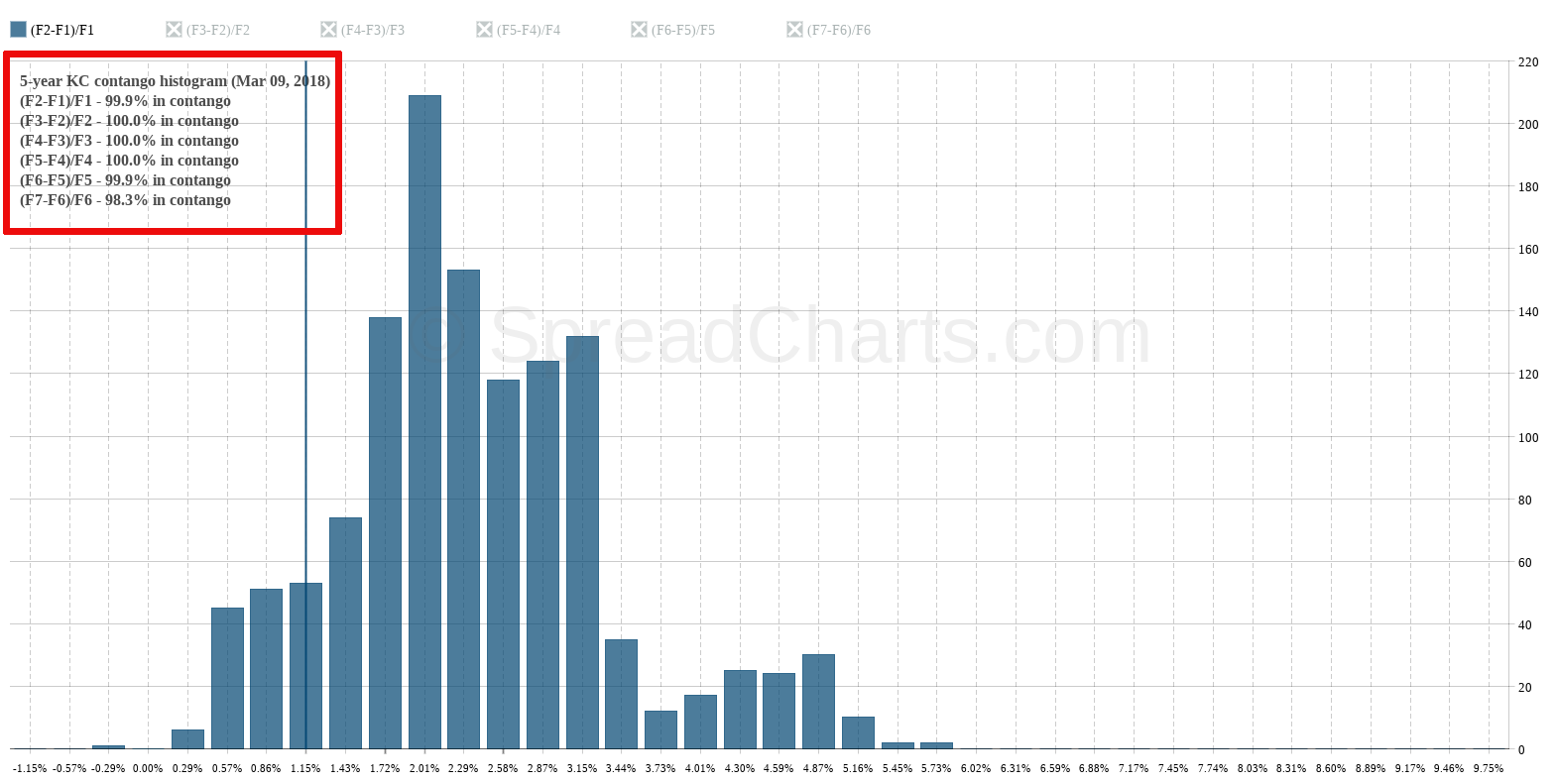

If the contango is strong enough, the spread can even rise despite the slightly rising price of the underlying commodity. Which is unusual, because bull spreads should profit in such a situation. Nice example is often coffee. This market is in contango majority of the time, we can see it on the contango histogram.

On the next chart, you can see an example when bear spread has gone higher (blue curve), while the price of the underlying (coffee futures) also grew quite significantly (purple curve).

These unusual movements of bear or bull spreads are a good indicator also for futures traders. Term structure behavior often tells us what’s going on “behind the curtain”. In other words, structural changes in the market often lead the price itself. It can help us better predict future price movements of the underlying asset.

What’s next?

Next time, we’ll finally take a look at the long-promised topic – choosing the right combination of contracts in a particular market situation.

Check out these great articles as well

New data: Sector indices

Our software is already established well beyond commodity market analysis. Stock indices, currencies, and even...

Read moreWhat’s new in the SpreadCharts app?

It’s been a few months since we launched the new version of the SpreadCharts app....

Read moreA major new version of the app is here

Today, we’re excited to show you the major new version of the SpreadCharts app that’s...

Read moreLiberation Day!

Tariffs are arguably the dumbest part of Trump’s agenda. Yes, the goal makes perfect sense,...

Read more