Commodity spreads 6: How to trade commodity spreads?

Welcome to another part of our spread trading series. We already know quite a lot of things. We understand what commodities and spreads are, we have revealed what is behind the existence of the spreads, we have explained what contango and backwardation are. However, we still must explain one important thing – how to trade the spreads.

Homework

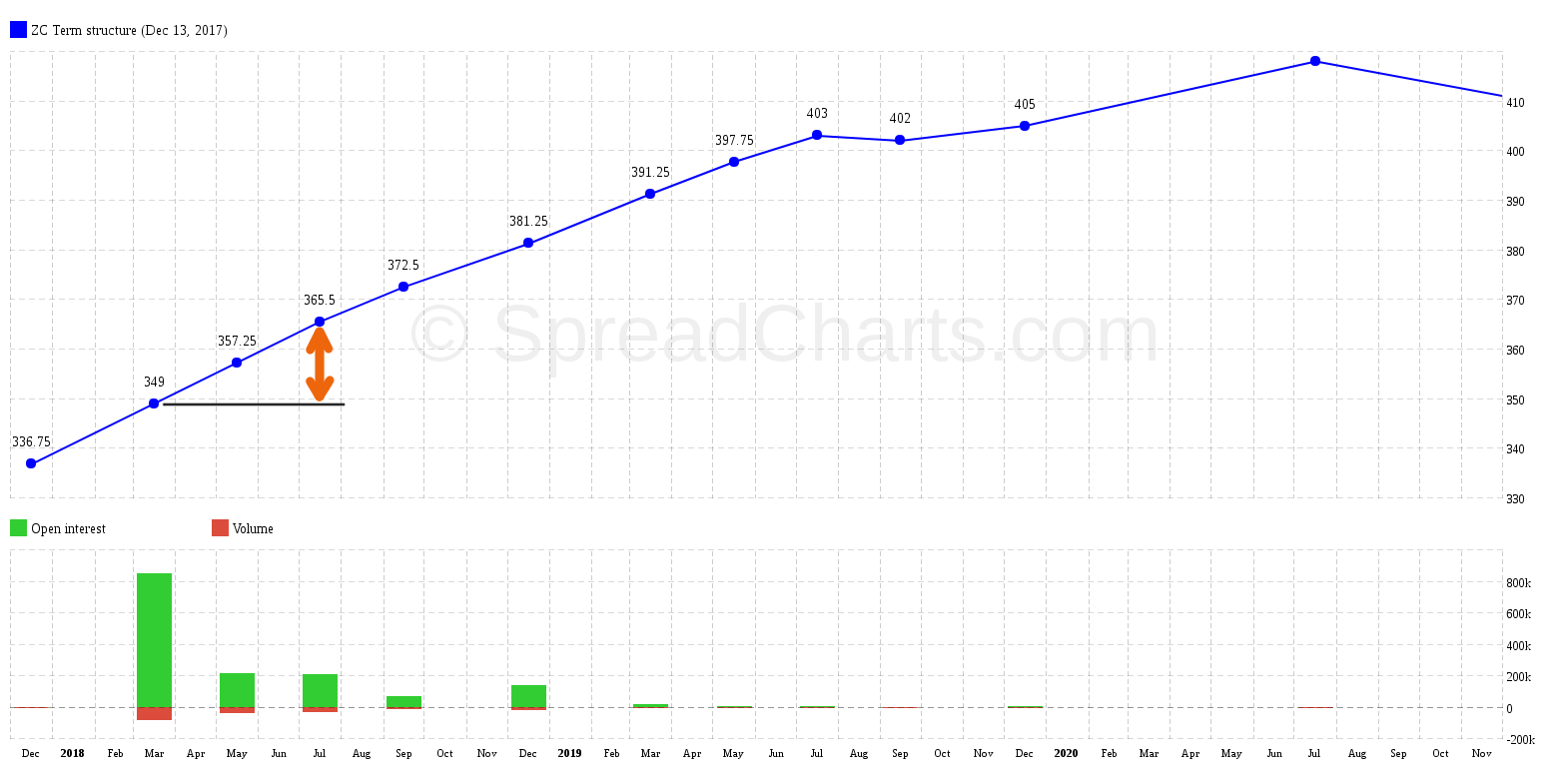

Let’s start with checking the homework from the 4th part of the series. Its goal was to find the spread’s value on the term structure for corn between the futures contracts expiring in March and July. On the following chart, you see the arrow that represents our spread. The size of this arrow highlights the price difference between the two contracts.

Simple as that! We use basic mathematics, nothing more, nothing less. Later, I will explain to you that spreads can also be negative. However, I do not want to jump too much forward right now. Now comes the question of how we buy this spread?

Two contracts – how to work with them?

This is probably the cause of the biggest worries when someone wants to trade commodity spreads. We have prices of two contracts. However, how to trade only the price difference between them? When we trade the outright futures, it is clear. Either we go long (we speculate on the growth, we are buying a contract), or we go short (we speculate on the decline, we sell a contract).

How to deal with a spread? Do we have to follow the prices of both contracts? In my beginnings, I was as surprised as you might be right now. But do not worry, it’s much easier than it seems at first glance.

We’ll be using a very simple quotation: LONG – SHORT. This means that one contract is bought, and the second contract is sold at the same time.

It may still look complicated. Sure, you’re asking how we can trade two contracts at the same time? In fact, it is easy. Commodity exchanges recognize interdelivery spreads. Most brokers, therefore, provide a so-called combo order. You simply choose one contract for long and second contract for short in the trading platform to create a spread combo order. In other words, you will look at the spread as a whole, like a single investment instrument, just like a futures contract or stock.

The beauty is in simplicity

So, if we have a spread selected in the platform and we are interested in opening a trade, we can either choose to buy (long position) or sell (short position) the spread. The broker then opens both contracts at once. So, there are no problems with two contracts. And to make the spread trading even easier, we will always speculate on the growth of the spread. So, we will always enter the position as long and we will get out of position using a sell order. This is just for simplicity so that we won’t make a mistake in buy/sell selection during entering or closing our position (which is quite common actually).

If we want to speculate on a drop in the spread’s price, we can do this by switching the legs of the spread. That means creating an inverted spread. That’s why you need to be very careful about the right settings! It does matter which contract we buy and which we sell! That’s what we’re going to study in the next articles.

Two simple rules

From today’s lesson, you should take these two rules:

- LONG-SHORT

- speculation on growth

What’s next?

Next time, we will finally come to the explanation of why it is less risky to trade spreads. I mean, of course, inter-delivery spreads. Perhaps you already know why it is so. Nevertheless, we’ll find out in the next part of our series.

Check out these great articles as well

A major new version of the app is here

Today, we’re excited to show you the major new version of the SpreadCharts app that’s...

Read moreLiberation Day!

Tariffs are arguably the dumbest part of Trump’s agenda. Yes, the goal makes perfect sense,...

Read moreWhy is the Dollar falling when stocks are cratering?

We have received the same question from several of our subscribers over the past week....

Read moreIntroducing the COT small traders

The SpreadCharts app is well known for offering data and features that provide a material...

Read more