Hedgers vs. Speculators

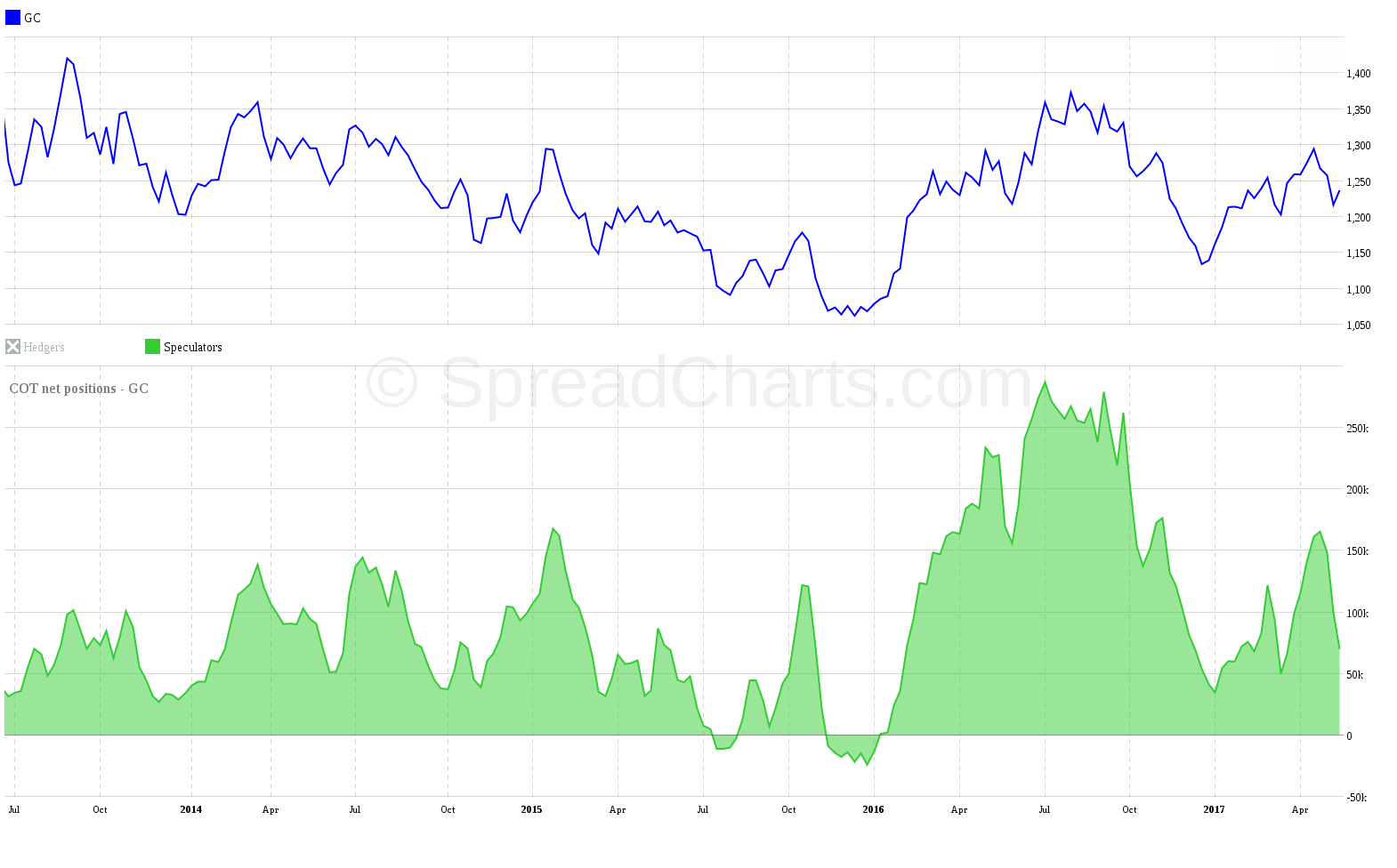

In one of my recent articles about the COT report, I focused on the group of hedgers. Today, I would like to follow up on this topic with the second large group of market participants – the large speculators. This group is represented by the “Managed Money” in disaggregated COT reports or “Non-commercials” in the legacy reports. Why are they speculating on the exchange? What is their goal and why are they irreplaceable?

The group of large speculators consists of large hedge funds, index funds, banks and other asset management entities. This group of traders is not on the exchange to hedge the price of the commodity (as is the case with the hedgers). They don’t come into contact with the physical commodity. Their only goal is to make profit in the futures market.

This group mostly behaves as trend followers. When the price of the commodity rises, they go long. If the price of the commodity declines, they reduce their long positions. Most funds and bank can only hold long positions from regulatorly reasons, which is the reason why net positions of this group are usually positive.

But why is this group so important when they just speculate and try to make a profit? In the nature, physics and our everyday lives, the balance is very important and must be preserved. That’s true also in trading. The hedgers insure their business through the futures exchange against the undesirable movement of commodity prices. This risk, which they want to minimize or ideally eliminate, can’t just disappear. Here’s where the speculators come, because they are willing to take this risk in exchange for a chance to profit.

They try to predict the price by using various analyses. When they open a new position, they aren’t interested in the real physical commodity. Instead, their goal is to maximize their profit. In order to do so, they have to take the risk that the hedgers want to get rid of.

Second very important thing is that speculators bring liquidity to the market. Without them, there would be no market where hedgers would be able to hedge their physical commodity. Higher liquidity also mitigates volatility and reduces spreads between the buying and selling price and therefore the costs for everyone involved.

The conclusion is simple. Both groups are very important for the market. Despite having different goals, they need each other to achieve their goals. The hedgers keep the futures price connected to with the underlying physical commodity, which is something speculators need for their bets to play out. And the hedgers wouldn’t be able to effectively hedge their production without the liquidity and risk taking attitude of the speculators. Together, these very different groups make the effective marketplace all of us can trade on.

Check out these great articles as well

New data: Sector indices

Our software is already established well beyond commodity market analysis. Stock indices, currencies, and even...

Read moreWhat’s new in the SpreadCharts app?

It’s been a few months since we launched the new version of the SpreadCharts app....

Read moreA major new version of the app is here

Today, we’re excited to show you the major new version of the SpreadCharts app that’s...

Read moreLiberation Day!

Tariffs are arguably the dumbest part of Trump’s agenda. Yes, the goal makes perfect sense,...

Read more